Restricted Funds: What Are They? And Why Do They Matter?

Thursday, December 14, 2023

Imagine a nonprofit organization that has fallen on hard times (a problem that many nonprofits encountered in the beginning stages of the pandemic). This organization is struggling to come up with the funds to continue paying for the operational expenses and scrambling to come up with the money to make rent. However, their bank account shows a balance of $500,000. How can this be?

This type of situation is possible when the $500,000 the organization has in the bank is restricted for a specific purpose. When a donor designates their gift to be used for a particular project or campaign, the nonprofit must honor that. Therefore, this organization must try to raise additional unrestricted funds in order to generate the funds necessary for their rent payment.

In this guide, we’ll discuss restrictions on nonprofit funding and why they must be accounted for in each organization’s financial management system. We’ll cover the following points:

- What are restricted funds?

- Why are restricted funds important?

- Types of Restricted Funds

- Accounting for Restricted Funds

- Challenges and Opportunities of Restricted Funds

- Managing Your Restricted Funds

No nonprofit should need to fall into the situation described above. That’s why it’s so important to understand restricted funds and the part they play in your organization’s budget. That way, you can make sure there is a balance between restricted and unrestricted funding, allowing your organization to prepare adequately and prevent misallocation of funding.

Need help managing your nonprofit’s restricted funds? We can help!

Contact JitasaWhat are restricted funds?

Restricted funds are any donations made and earmarked for a specific purpose by the donor. Donors have the legal right to restrict the donations they contribute to organizations (typically nonprofits) and require that their gifts be used only for very limited and specific purposes.

For example, a major donor might decide to give a gift of $650,000 to an organization but require the funds be placed in an endowment. The money they contribute would then be considered permanently restricted. That donor may further restrict the interest made off of the contribution and require it to be used for a scholarship program.

What is the difference between restricted and unrestricted funds?

On the flip side of restricted funds are unrestricted funds. These are the donations and contributions made to organizations without any earmarked direction. The organization can choose what their greatest need is for those funds, and allocate them as they see fit.

For example, while the major donor in the previous example gave a restricted gift of $650,000, another donor might give a smaller contribution of $1,000 and not specify where the gift will go at all. This means the nonprofit may decide to use the funding to finance a program, pay their rent, contribute toward employee salaries, and more.

Typically, nonprofits prefer to ask for more unrestricted contributions than restricted ones because it provides the flexibility they need to allocate money to the programs and projects with the greatest need. However, major donors are more likely to restrict their contributions to ensure the money is going toward the program or cause they’re most passionate about.

Why are restricted funds important?

Restricted funds are important from a number of perspectives.

To donors, restricted funds are important because they can ensure they understand exactly where their contribution is going and can dedicate it towards the program they’re most passionate about.

For example, let’s say a donor contributes a gift to an organization that specializes in helping the homeless population. The donor’s friend struggled with homelessness and confided in them about the challenges of getting food on a regular basis, so the donor wants to be sure their contribution is dedicated toward the serving kitchen at the organization. This donor is able to help the cause while ensuring their contribution is going toward the program that means the most to them.

To nonprofits, restricted funds are important because many major donations that help fund large initiatives are restricted by the contributor.

Major donations can make a huge impact on your organization’s various programs. For example, let’s say the same organization that helps address homelessness needs a total of $500,000 to fund their service kitchen and food pantry for the year. If a major donor contributed $250,000 to this program, the organization has already funded half of the year’s program!

Finally, restricted donations are incredibly important to the IRS, which tries its hardest to make sure nonprofits remain financially accountable to donors and those they serve.

If a nonprofit fails to honor restrictions and these indiscretions are discovered via financial audit or annual tax forms, they may face major penalties from the IRS, including the potential loss of their exempt status. They may also face legal action from the donor who restricted the gift, who can sue the organization for misallocation of funds.

Gifts with Restrictions

Most often, when we discuss the different gifts with restrictions, we’re talking about donor-restricted gifts. These are generally large donations made by individual contributors that are restricted by the individual donor for specific purposes.

Usually, the restriction is either brought up by the donor or by the nonprofit itself. Donors may give unsolicited restricted contributions to nonprofits, but more often, they arise out of ongoing conversations between the donor and the organization.

For example, during a capital campaign, the nonprofit may self-restrict the donations coming from major contributors during the quiet phase of the campaign. These funds must be used to fund the program or project that the capital campaign is dedicated to.

Keep in mind, however, that individual contributions aren’t the only revenue that can be restricted.

More and more commonly, the grants that nonprofits receive from other organizations and foundations are also restricted to specific purposes. Unrestricted grants do exist, but they’re not as common as restricted ones. When nonprofits write grant proposals, they should be specific when describing how the funds will help the organization and appeal to the grantor’s guidelines.

If your organization wins multiple grants, you’ll need to keep up with all of the restrictions placed on different grant monies and manage the follow-up expectations with the funders. They may require you to send updates and reports about how you’re using the funding to accomplish the goals set out in your grant proposal. That’s why grant management is such an important aspect of restricted funds as well.

Types of Restricted Funds

There are two primary types of restrictions that nonprofits will encounter in the contributions made from donors and grants. These contributions are either permanently or temporarily restricted for the organization.

Permanently Restricted Funds

Permanently restricted funds are assets given to a nonprofit organization that are not to be spent directly on various projects or initiatives. These funds are instead used in endowments to garner interest for the organization and that interest is used to fund projects or programs.

A common example of this type of restricted fund is a scholarship fund. A major donor might contribute a gift of $50,000 to set up an endowment fund to fund several scholarships over time. Let’s say the fund yields around 4% interest every year. This means the fund will generate $2,000 in interest annually, allowing the organization to set up an annual, ongoing scholarship using that interest.

Temporarily Restricted Funds

Meanwhile, temporarily restricted funds are bound either by a time limit or a specific purpose. Once the purpose is fulfilled or the time expires, these funds are released from restriction and placed in the unrestricted funding category. Whether you’re allowed to do this will depend on the agreement made between your nonprofit and the donor upon receiving the contribution.

Let’s say an education-focused nonprofit built a new center for their children’s program, a project for which the budget was originally set at $200,000. However, it ended up under budget, only requiring $190,000 to complete. The additional $10,000 was part of a major donor’s contribution that was temporarily restricted to complete the project, but the donor agreed to release it from restriction when the project was completed. So, the additional $10,000 could be added to the organization’s unrestricted funding and used for other initiatives.

When reporting on your organization’s finances, temporarily restricted funding should be recorded in the category of temporarily restricted net assets, a term used across various financial statements to refer to the portion of your nonprofit’s available resources that have donor restrictions. Once funds are released from restriction, they’re recorded under your unrestricted net assets.

Temporarily Restricted Net Assets vs. Deferred Revenue

Temporarily restricted net assets are sometimes confused with deferred revenue in the context of a nonprofit's finances. However, the two terms aren’t synonymous—although they both describe revenue your organization isn’t allowed to freely spend at this time, they’re treated differently both in their practical application and in financial reports.

Deferred revenue refers to funding that your organization has received but isn’t yet allowed to recognize as income in your accounting system. This occurs when the agreement between your nonprofit and the donor is conditional upon your organization providing goods or services to the donor. By contrast, the donor’s conditions for temporarily restricted net assets are related to how you’ll use the funding, and you can record the contribution as income right

Until you deliver the goods or services, deferred revenue is seen as a liability and is recorded as such on your statement of financial position. Once the obligation is met, the revenue becomes an asset and is typically unrestricted.

For example, let’s say a science museum with a 501(c)(3) designation offers week-long summer day camps for children. To make advance planning easier for the organization, signups open in February each year. Although parents pay the participation fee at the time of registration, the organization can’t recognize those fees as revenue in their financial reports until the summer because that is when they’ll provide the parents the promised service of a week of camp for their children. Therefore, until the actual summer camp session rolls around, the registration fees are considered deferred revenue.

Accounting for Restricted Funds

Not accounting for restricted funds can result in nonprofits being sued by their contributors for misuse of funding or the loss of their tax-exempt status. Therefore, organizations must keep a close eye on their restricted funds, ensuring they earmark these funds for their dedicated purpose, and don’t misallocate funding.

That’s why certain measures have been taken to keep restrictions in mind when operating with fund accounting. Various statements and reports all take into account the restrictions placed on funding so that organizations can view these restrictions and make financial decisions based on their actual funding rather than an inflated amount when restrictions are not taken into account.

Notably, restrictions are specifically noted in your organization’s statement of activities, statement of financial position, and must be referenced when creating your organization’s budget.

Statement of activities

Your nonprofit’s statement of activities shows how different revenues and expenses are categorized by your organization. It’s split into three sections—revenue, expenses, and net assets. Then, it’s further divided into three columns—unrestricted, temporarily restricted, and total funds.

When the statement of activities is completed, it will look something like this:

This statement is designed to show organizations how they’re allocating their resources and how their use of funding helps advance the organization’s core initiatives. In the example above, you can see that $150,000 of the funds for this organization are restricted and must be used for a specific purpose.

Their other funding can be used for other expenses like programs, administrative costs, and fundraising. By separating the restricted funds from the unrestricted, this organization can see what funds they have the capacity to move around and use for various purposes and which ones cannot be moved around.

Nonprofit Statement of Financial Activities Template

This template provides a clear and organized way to present financial information, including revenues, expenses, and net change in financial position, by class, location, and project.

Free DownloadStatement of financial position

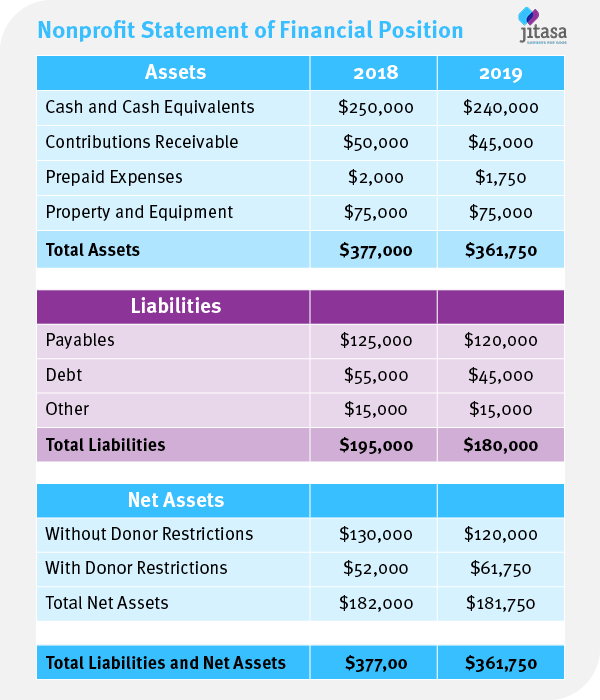

Your nonprofit’s statement of financial position is used to help your organization determine its liquidity and represent your financial health. The statement shows the organization’s assets, liabilities, and resulting net assets.

As you can see in the following image, the net assets section further breaks down the funding into assets with donor restrictions, those without, and the total for the organization.

From this statement, nonprofits can calculate their months of LUNA (liquid unrestricted net assets) to determine their liquidity and flexibility to assume risk and expand their operations. You can find this calculation by subtracting the property and equipment (non-liquid assets) from the net assets without donor restrictions.

This allows you to take restricted funds out of the equation, as they only have very particular uses and are therefore not considered as “liquid.”

Nonprofit budget

When your nonprofit creates a budget, you need to allocate funds according to the restrictions and exempt those with permanent restrictions. You must take these into account as you create your budget to ensure you have the funds necessary to cover your expenses and can allocate enough funding for each program.

Imagine this: you estimate that your nonprofit will receive $2,000,000 total in your bank accounts for the year. Your expenses you need to cover include the following:

- Operational expenses. This includes your rent, utilities, employee salaries, and other general expenses. To fund the organization for one year, you need $475,000.

- Fundraising expenses. Fundraising expenses include the events you host, the acquisition of fundraising technology, and the cost of running campaigns. To fund your fundraising expenses for a year, you need $200,000.

- Program A. This program costs your organization an average of $500,000 per year.

- Program B. This program costs your organization an average of $450,000 per year.

- Program C. This program costs your organization an average of $300,000 per year.

All told, this means your organization will incur $1,925,000 per year. However, let’s say $100,000 of your nonprofit’s funding is permanently restricted. This means your organization will need to raise an additional $25,000 or find an opportunity to cut that amount from the expense budget to meet the $2,000,000 that you expect to raise throughout the year.

Use your various statements and the information in your chart of accounts to be sure your budget adequately reflects the unrestricted funds in your system and leverages the temporarily restricted funds as they’re designed to be used.

Nonprofit Budgeting Course

This nonprofit budgeting course is designed to teach nonprofit organizations how to effectively allocate their resources in order to achieve their missions.

Free CourseChallenges and Opportunities of Restricted Funds

Restricted funds present both challenges and opportunities for organizations. It’s important to recognize the value they can bring to your organization as well as how to react to these challenges so that you can effectively manage your nonprofit’s financial resources.

Challenges

If your organization raised only unrestricted funds, budgeting and allocation would be much easier! You would be able to allocate your funds easily based on the discretion of your nonprofit and based on which programs have the greatest need at your organization. One of the challenges of restricted funds is that they present another factor to take into account when making these allocations.

This means you might need to raise a little more than originally planned to cover your expenses or that your accounting information may look misleading before taking a deep dive into the more specific statements and reports.

Another challenge that your organization may encounter is an unsolicited gift with restrictions that aren’t in line with your organization’s strategy. Let’s say you’ve already received a $400,000 restricted gift to cover a program that will cost $450,000. If another donor offers a $200,000 gift for the same program, you’ll have limited use for the gift. In this case, you have two potential solutions:

- Ask the donor if they’d be willing to change the restrictions. Most supporters are willing to make these types of changes because their primary goal is to simply help the cause succeed.

- Refuse the gift altogether. If an individual refuses to change their restrictions or if it becomes clear they have a selfish purpose for restricting it in the way they did, you can always turn them away.

This doesn’t mean restricted funds are always a major challenge or hassle for your organization! The benefits of these funds often outweigh the challenges they present.

Opportunities

The primary benefit of restricted funds is that they usually make up the largest donations made to nonprofits. While it would be great to receive a major gift for your organization that is entirely unrestricted, most individuals wish to place restrictions on these contributions.

This means that restricted funds that are allocated toward real needs at your organization can make a big difference and cover a large portion of your budget. This requires you to work closely with your supporters and collaborate to find a cause or program at your organization that both sparks their interest and satisfies your needs.

Luckily, this usually isn’t too challenging! Those who give your largest (usually restricted) gifts are donors with whom your organization has strong relationships. Therefore, setting up a meeting with each supporter to discuss options for gift restrictions can be pretty simple. As mentioned, most of your donors want to help in any way possible.

Managing Your Restricted Funds

As we mentioned, one of the challenges associated with restricted funds is the management of those funds. It can be difficult to make sure that all funds are allocated to the right purpose and to ensure you’re remaining compliant with the IRS and accountable to your donors.

However, it’s expensive, time-consuming, and reputation damaging if you misallocate and misuse your funds, even by mistake! Not only could you risk your tax-exempt status, but you also risk legal fees and potentially having to provide a refund to the original donor. That’s why it pays to have a nonprofit accountant on your side to help manage these funds.

Our fund accounting experts here at Jitasa specialize in helping nonprofits and other organizations in the social good sector keep their finances well-organized and maintained.

Your dedicated accountant will help your organization craft a budget that takes into account your restricted funds, pull reports that provide insights into how restrictions impact your financial management, and more.

If you’re interested in learning more about how nonprofit accounting is unique and the impact restricted funds have on finances, check out these additional resources:

- Nonprofit Accounting: A Guide to Basics and Best Practices. Restricted funds are only one aspect that makes nonprofit accounting unique and different from for-profit accounting. Learn more about what else makes it different in this guide.

- Nonprofit Budgeting: Understand the Basics + Template. Want to take a deeper dive into how your budget takes into account your various restrictions and unique financial needs? Check out this nonprofit budgeting guide to learn more.

- Working with a Nonprofit Accountant: What to Expect. Nonprofit accountants are there to help you manage your organization’s finances appropriately. Learn more about what it’s like to work with a dedicated accountant on your side.

Need help managing your nonprofit’s restricted funds?

Your dedicated Jitasa accounting expert can help!

Learn more