Nonprofit Statement of Activities: A Comprehensive Guide

Tuesday, November 28, 2023

Nonprofit accounting is unique in many ways. While for-profits focus on making as much income as possible to make more money for themselves, nonprofit organizations focus instead on how they can raise additional revenue to further their missions. All of a nonprofit’s funds should be reinvested into the organization and its mission.

For-profit accounting departments have a standard set of reports and statements they run to analyze their finances. Nonprofits have essentially parallel reports, but because their accounting is different, the reports differ slightly as well.

One of these central reports run by nonprofit accountants is the statement of activities, sometimes known as an income statement. In this guide, we’ll walk through the basics of this accounting statement, covering the following topics:

- What is the nonprofit statement of activities?

- Is there a difference between a statement of activities and an income statement?

- Why the nonprofit statement of activities is important

- Structure of the nonprofit statement of activities

- Nonprofit statement of activities template

Your organization works hard to raise funds and to use those funds to further your mission. Ensuring your reports are in check will help your nonprofit make the most of your finances moving forward. Let’s dive in to learn more about the specifics of your nonprofit statement of activities.

Work with the experts at Jitasa to compile your statement of activities.

Request a QuoteWhat is the nonprofit statement of activities?

The nonprofit statement of activities (or income statement) is a financial report that shows your organization’s revenue and expenses over time, ultimately allowing your organization to analyze your net assets. It’s also used to categorize your nonprofit’s revenue and expenses.

The purpose of the nonprofit statement of activities is to provide detailed information about the organization’s transactions and how those activities help further the organization’s mission through various initiatives and programs.

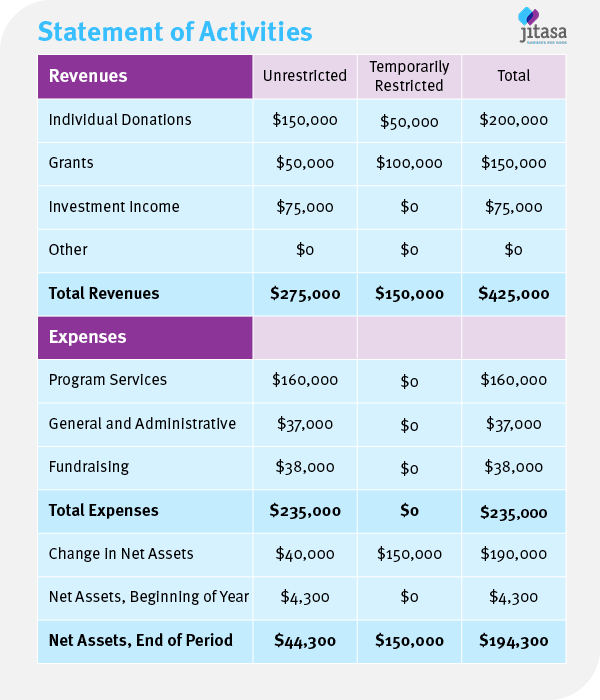

When your statement of activities is complete, it will look something like this:

As you can see, the report is divided into the revenue and expenses along the vertical axis. Horizontally, the revenue and expenses are further categorized by restrictions placed on the funds. At the bottom of the report, there’s a section dedicated to the organization’s net assets.

The numbers for your statement of activities are pulled from your organization’s chart of accounts, and the net assets are calculated using those numbers after they’re put into the income statement itself. Therefore, you need to make sure that your accounting system is well organized from start to finish, or else you may have errors in your statement.

While for-profits need to compile a profit and loss statement along with their income statement, nonprofits can skip that step because they’re not operating for profit. The statement of activities is simply to show how the organization is using its revenue and expenses to support its mission.

NonProfit Statement of Activities Template.

Download for FreeIs there a difference between a statement of activities and an income statement?

In the broadest sense, the answer is no. The nonprofit statement of activities and the income statement are two different terms that refer to the same report.

The only difference between these terms is that “income statement” is more commonly used by for-profit organizations, while “statement of activities” is more popular among nonprofits. Many nonprofits find that the word “activities” better reflects their focus on mission-driven work and the fact that they bring in revenue from a variety of sources—not just earned income.

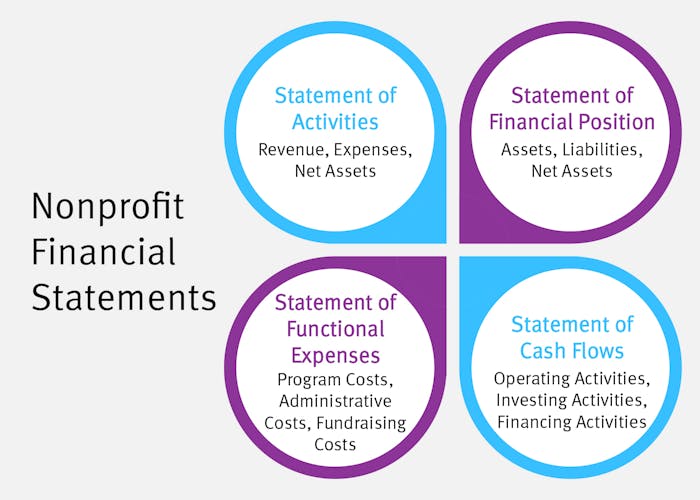

The term “statement of activities” is also more in line with the names of the other three financial statements nonprofits compile annually than “income statement” is. These reports include the:

- Statement of financial position. Also called a balance sheet, this report breaks down your organization’s assets and liabilities to provide a snapshot of its financial health.

- Statement of cash flows. This statement shows how cash moves in and out of your organization through operating, investing, and financing activities to help you stay on track with your spending and fundraising.

- Statement of functional expenses. This report organizes your nonprofit’s expenses into the categories of program, administrative, and fundraising costs so you can see how your expenditures are being used to further your mission.

Each of these four statements—including the statement of activities—summarizes your organization’s data differently, providing unique, applicable insight you can use to improve your financial management strategy.

Why the nonprofit statement of activities is important

Nonprofits must compile an income statement every year to be in accordance with the Generally Accepted Accounting Principles (GAAP). However, it’s more than just a requirement. The statement of activities can be incredibly helpful when your nonprofit is analyzing its finances and trying to determine where those hard-earned fundraising dollars go.

When you examine your nonprofit statement of activities, it should be clear that the line items in the statement match up with those in your organization’s budget. This allows your organization to make sure you’re on track with your budgeted regular expenses.

By analyzing your nonprofit’s statement of activities, your organization can determine if the expenditures currently allocated for each of your programs are sustainable for the long run. You can use the information in this statement to better understand if now is the right time to cut expenses, provide membership discounts, or secure additional funding through grants or sponsorships.

The cherry on top is that an accurate income statement can help your organization complete your annual tax return. You’ll need to record information about your organization’s expenses and revenue on your tax forms. Between your statement of activities and statement of functional expenses, you’ll be all set to file your Form 990 accurately each and every year.

Structure of the nonprofit statement of activities

Your nonprofit statement of activities is split into several different sections. Vertically, it’s split into revenue, expenses, and net assets. Meanwhile, horizontally, it’s split into your organization’s unrestricted and restricted revenue.

Revenue

Nonprofits receive revenue from a number of different sources, all of which are essential to helping the organization pursue its mission. The majority of this revenue will be recorded as gross in your statement of activities. However, your investment returns should be recorded as net.

Some of the revenue sources that need to be recorded in the nonprofit statement of activities include the following:

- Cash contributions. When nonprofits raise money from individual donors, major supporters, and corporate partners, these are all considered cash contributions.

- Donated materials. In-kind donations are often made to nonprofit organizations in support of their missions. While these may be more complex to record in your financial systems, it’s still important to recognize these gifts in your financial statements.

- Non-cash contributions. When individuals transfer assets like land and stocks to your organization, these contributions are still worth money, but don’t quite fall under the category of “cash.”

- Grants. Whether you’re receiving money from the federal and state governments or a private foundation, you need to record your grant revenue in your statement of activities.

- Program fees. Many organizations receive a large portion of their funding as fees charged for their services. For instance, associations require members to pay fees to receive the benefits offered through the organization.

- Investment returns. Nonprofits can invest their funds in order to earn interest and multiply their revenue, just as individuals can. However, any funding brought in through this method needs to be reported on the income statement.

Finally, one of the categories often listed as revenue on your statement of activities is your net assets released from restriction. These are the funds that you are now able to use as unrestricted revenue, although they may have been restricted in the past. Because restrictions on revenue are a key element to be recorded in your statement of activities, let’s explore them a bit further.

Revenue With Restrictions vs. Unrestricted Revenue

Sometimes, revenue earned by nonprofit organizations has restrictions placed on it by the revenue source. For example, granting organizations may require the funds provided to be dedicated toward a specific service or purpose.

Restricted revenue must be used for a specific intended purpose. Meanwhile, unrestricted revenue can be allocated toward projects, operations, and other expenses as chosen by the nonprofit itself.

Also included in your restricted revenue is temporarily restricted revenue. These funds are restricted during a certain period of time. After that time elapses, they can be released from restriction and used as the nonprofit sees fit.

The nonprofit statement of activities separates revenue with and without restrictions so that organizations can see the flexibility in their funding in addition to the sheer amount of it.

Expenses

The expenses your organization incurs should all support your mission in some way, whether that’s by funding daily nonprofit operations or a specific project relevant to your mission’s purpose.

You’re required by FASB 117 to report your expenses by functional classification, meaning you’ll need to at least split up your expenses by administrative, fundraising, and program costs.

Some of the operational expenses that your organization will incur include the following:

- Salary and wages

- Insurance

- Rent and utilities

- Legal services

- Accounting services

- Supplies and equipment

- Retirement compensation

- Fundraising

Meanwhile, program expenses vary drastically between nonprofits. For example, an animal shelter nonprofit organization may incur program expenses such as:

- Medical supplies for animals

- Leashes, collars, toys, and crates

- Food for the animals

- Training expenses

Generally, nonprofits try to limit their operating expenses as much as possible to lower their overhead. It’s important to find the balance between reducing overhead to fund your mission and ensuring you dedicate enough funding to your operating activities to continue growing and expanding your organization.

Net Assets

The net assets featured on your nonprofit statement of activities are simply your expenses subtracted from your revenue. This calculation shows the equity of your nonprofit organization and whether you have the revenue to cover expenses, creating a sustainable organization.

Be sure to pay attention to the net assets available to your organization under the “without restrictions” column of your statement of activities when analyzing the document for sustainability. If you were to simply subtract the total expenses from total revenue without taking restrictions into account, you might have a false sense of security.

For instance, if your nonprofit has $55,000 in expenses and $65,000 in total revenue, it would appear that your net assets are positive, at $10,000. However, if $15,000 of your revenue is restricted, you’re actually $5,000 in the red and should cut expenses to maintain a sustainable organization.

Nonprofit statement of activities template

Every nonprofit’s income statement will look a little bit different. If you haven’t seen one for your organization yet or want to try your hand at compiling one, use our template to get started.

Putting together this important resource can be challenging—not to mention checking that the numbers are correct, interpreting your income statement, and coming up with the next actions that your organization should take based on the insights you glean.

To make this process easier, we recommend that your organization partner with a nonprofit accountant like the experts at Jitasa. Our team will meet you where you are in compiling your statement of activities, analyze your financial data, and make tailored recommendations to improve your revenue and expense allocation going forward.

Wrapping up

The nonprofit statement of activities is one of the core accounting documents that your organization creates. It allows you to see how your organization uses its funding to advance its mission and allocate resources. In addition, your income statement can be used to determine how sustainable your organization’s finances are so you can make informed decisions for the future.

If you’re interested in learning more about nonprofit accounting, the statements that you compile, and the conclusions that can be drawn from those statements, check out the following resources:

- How Do Nonprofits Make Money? Making Nonprofits Profitable. Explore the different revenue sources that may be included in your nonprofit’s income statement.

- Restricted Funds: What Are They? And Why Do They Matter? Dive deeper into the important designation of restricted vs. unrestricted funds that appears on the statement of activities.

- Working With a Nonprofit Accountant: What to Expect. Discover what it’s like to work with a nonprofit accountant to compile your statement of activities and interpret your organization’s financial data.

Contact Jitasa’s team of nonprofit accountants to compile your statement of activities.

Request a Quote