Nonprofit Budgeting: How to Get Started + Template

Wednesday, March 5, 2025

If you’ve created a budget for your household before, you probably averaged your expenses, calculated your income, and determined how much you could save for the future. Nonprofit budgeting follows a similar process, except you’re projecting revenue and expenses for your entire organization.

Budgets are critical documents for effective nonprofit financial management. In this guide, we’ll cover the essentials of these resources, including:

- Nonprofit Budgeting FAQ

- Elements of a Nonprofit Budget

- How to Apply Your Nonprofit Budget

- Nonprofit Budget Template & Example

You don’t have to be an accountant to run a nonprofit (although it’s immensely helpful to work with one!), but you should have a general understanding of where your organization’s funding comes from and how your team is using it to further your mission, which your budget will help you learn. Let’s dive in!

Partner with Jitasa to create accurate, actionable budgets for your nonprofit.

Request a QuoteNonprofit Budgeting: Frequently Asked Questions

To clear up any confusion surrounding these resources, we’ll begin by answering some common questions about nonprofit budgets.

What is a nonprofit budget?

A nonprofit budget is a planning document used to predict expenses and allocate resources for your organization. It details the costs your organization will incur and the revenue you expect to receive over a set period of time.

In addition to planning, budgets should serve as guides for monitoring your nonprofit’s spending, fundraising, and general financial standing. So, treat your budgets as living documents and center them in your nonprofit’s financial activities throughout the year. (more on this later!)

Are there different types of nonprofit budgets?

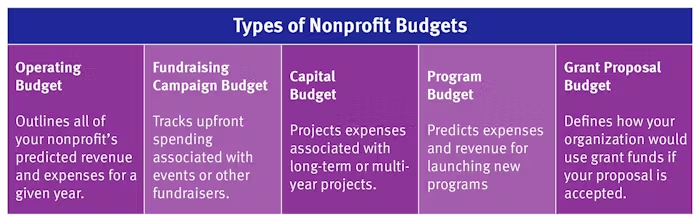

Yes! While you probably use the term “budget” to refer to the master financial plan you create annually for your entire organization most of the time, there are at least five types of nonprofit budgets you should be aware of, including:

- Operating budget: This is the master financial plan described above that outlines all of your nonprofit’s predicted revenue and expenses for a given year.

- Fundraising campaign budget: These budgets help track upfront spending associated with revenue-generating initiatives, especially highly involved fundraisers like events or GivingTuesday campaigns.

- Capital budget: This budget projects the expenses associated with multi-year, long-term projects (such as capital campaigns) and details the revenue you’ll use to cover those costs.

- Program budget: Since launching new programs often causes your organization to incur many one-time expenses, you may create separate budgets for them while you get them off the ground.

- Grant proposal budget: Grantmakers want to know that the organizations they award funding to will manage those grants wisely, so they’ll usually request that a proposed budget be included in applications. Most funders ask to see all revenue and expenses associated with the initiative you plan to fund with the grant, so reference your program or capital budgets as you create these.

For the purposes of this article, we’ll focus primarily on operating budgets because of their central role in nonprofit finance. However, you can adapt some of our tips to create other types of budgets. Additionally, remember that any budget that covers a specific aspect of your nonprofit’s spending and fundraising should align with your operating budget.

Who is in charge of nonprofit budgeting?

The responsibility of creating your operating budget typically falls to your chief financial officer (CFO) or nonprofit controller. These professionals focus on your financial strategy and can use specialized tools to forecast your nonprofit’s cash flows for more effective resource allocation.

Other professionals who should be involved in the budgeting process include your:

- Accountant, who is very familiar with your nonprofit’s day-to-day financial situation and can provide reports and analysis to make even more accurate budgeting decisions.

- Board of directors, who need to approve all budgets before they go into effect in proceedings led by your treasurer.

- Fundraising team, who can contribute a deeper understanding of your organization’s revenue-generating capabilities and should have input on what expenditures are necessary for the year’s campaigns.

- Program or project leads, who should also have a say in the funding that goes toward their respective initiatives.

Since your annual budget touches every aspect of your organization’s operations, incorporating multiple perspectives into its creation makes it more actionable and helps everyone get on the same page about how best to use your nonprofit’s funding.

Do nonprofit budgets have to break even?

This question comes from a common myth about nonprofit budgeting—that because your organization can’t turn a profit by definition, your total predicted revenue for the year always has to equal your total expenses. In reality, the meaning of “nonprofit” is simply that your organization has to reinvest all of its funding into its mission rather than paying investors or shareholders.

If your nonprofit has the financial flexibility to budget for a revenue surplus, do so! When your predicted income exceeds your projected expenses, you’ll be more prepared to course correct if you incur unexpected costs or some revenue sources fall short of your goals. Plus, you can use any funding you don’t spend to build your organization’s reserve funds, which contribute to long-term sustainability.

Learn more basics and best practices of nonprofit budgeting in our FREE course!

Sign UpElements of a Nonprofit Budget

The most effective nonprofit budgets feature three general characteristics:

- Defined activities. Nonprofit strategic planning and financial planning go hand in hand. All of the expenditures you list in your budget should align with your organization’s major initiatives or cover the everyday expenses you need to keep your nonprofit running as you work toward those big-picture goals. Outline your revenue with your strategic plan in mind so you know how you’ll fund these expenses.

- Specific time periods. While your operating budget will cover an entire fiscal year, it’s also important to note when you’ll bring in and spend certain funding. For example, charitable giving tends to peak at year-end, so you might launch new initiatives in the first few months of the year when you have more funds for them. Timing is even more important for other types of budgets—for example, to help keep capital campaigns on track and ensure you have everything you need for an event before it begins.

- Realistic, measurable metrics. Be specific about the dollar amounts on both sides of your budget. When setting revenue generation goals, use past data to determine what your fundraising team is capable of, and choose targets high enough to push your team but not so far out of reach that they become discouraged. On the expense side, analyze each expenditure carefully to decide what spending is truly necessary for your organization to thrive and where you could reasonably cut costs.

With these features in mind, let’s dive deeper into the two sides of your nonprofit’s operating budget.

Revenue

Your nonprofit’s budget should be organized to align with other key financial resources, including your internal records, financial statements, and tax returns. Therefore, it’s most effective to categorize the revenue side by source.

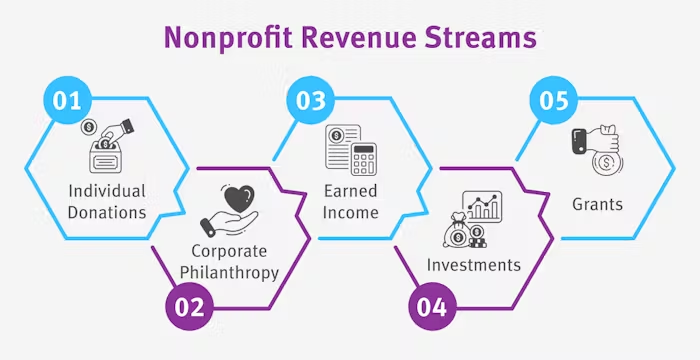

Here is a quick breakdown of some common funding streams that fall into each of the five main categories of nonprofit revenue:

- Individual donations: Small, mid-level, major, and planned monetary gifts; in-kind contributions of goods, services, and non-cash assets (e.g., stocks, real estate, and cryptocurrency)

- Corporate philanthropy: Matching gifts, volunteer grants, sponsorships, internal employee giving campaigns

- Earned income: Membership dues, merchandise sales, fees for services provided (e.g., museum ticket sales or animal shelter adoption costs)

- Investments: Treasury bills, bonds, mutual funds, interest generated from endowments

- Grants: Federal and state government grants; public, private, and family foundation grants

Note that some revenue sources bridge multiple categories and can be organized in different ways. For example, some nonprofits list corporate grants with their other grant funding, while others consider them a type of corporate philanthropy. You might also divide event revenue between the earned income and individual donation categories based on whether each aspect should be recognized as an exchange transaction (where the supporter received something in return for their gift, like admission to the event or an auction item) or a contribution transaction (an extra donation where nothing was promised in return).

Additionally, when forecasting the coming year’s revenue, it’s best to be cautious in your estimates so you’ll be more likely to have the funding you need to achieve your goals, no matter what external circumstances occur.

Expenses

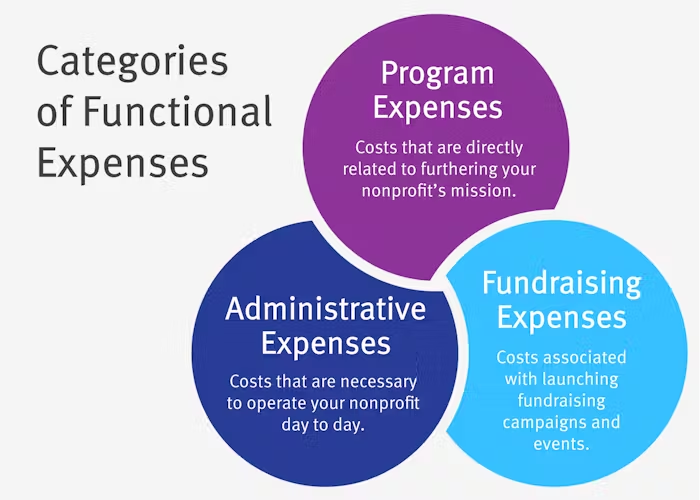

Generally speaking, there are two ways to organize expenses in your nonprofit’s operating budget. The natural expense method categorizes costs according to the nature of payments made, while the functional expense method categorizes expenditures based on how they further your organization’s mission. Although considering natural expenses is helpful during the planning process, your final budget should use functional expense categorization to match your financial reports.

The three major categories of functional expenses are as follows:

- Program costs. This category encompasses all expenditures directly related to furthering your nonprofit’s unique mission, so individual line items vary widely from organization to organization. For example, an animal shelter would put the costs of pet food and veterinary care under their program expenses, while a museum might include spending related to exhibit setup and maintenance in theirs.

- Administrative costs. Sometimes called operating expenses or “management and general” costs, administrative expenses are essential for running your organization day to day. Some natural expenses that fall into this category include staff compensation, utility bills, rent or mortgage payments, insurance, and office equipment purchases.

- Fundraising costs. This category describes the upfront expenses associated with revenue-generating activities. These often include event planning, marketing material creation, merchandise production, fundraising consulting fees, and purchases of specialized fundraising software, among other expenditures.

You may have also heard the term “overhead expenses,” which refers to your nonprofit’s combined administrative and fundraising costs. While this term often has a negative connotation because it’s widely believed that funding spent on overhead “doesn’t go toward your mission,” some overhead is essential for your organization to thrive. After all, to serve your community effectively, you need to raise the money to do so and keep your lights on!

However, this doesn’t mean that your nonprofit’s overhead spending can go unchecked or should be prioritized over program expenditures. In the past, the “rule” of nonprofit spending was that organizations should put at least 65% of their funding toward their programs and no more than 35% into overhead, but it’s now understood that the exact breakdown will look different for every nonprofit. Instead, treat this as a guideline to reduce overhead spending (within reason) before taking funding away from your programs if you need to cut costs.

How to Apply Your Nonprofit Budget

While you’ll create your nonprofit’s operating budget from scratch once a year, budgeting shouldn’t be a one-and-done event. Instead, your budget should guide your organization’s spending, fundraising, and reporting throughout the year, so check in with it frequently.

At least once a month, meet with your financial professionals, organizational leadership, and board to revisit your budget, assess your progress, and make adjustments as needed. During these reviews, there are several resources you should reference to inform your decision-making, including:

- Budget vs. actual comparisons. Typically created by your accountant, these reports show your actual spending and fundraising numbers alongside where you expected your revenue and expenses to be at that point in the year.

- Treasurer reports. These documents list all of your nonprofit’s revenue and expenses for a given month, compare your cash balance at the beginning and end of the reporting period, and allow the main financial expert on your board to share their perspective on your financial situation.

- Cash flow statements. One of the four core nonprofit financial statements, cash flow reports show the movement of cash in and out of your organization through operating, investing, and financing activities to provide a different perspective on your financial progress. These can be pulled monthly or annually, although many nonprofits choose the former so the report is more useful for recurring budget reviews.

During your last budget review meeting of each quarter, review your financial data more closely and take more time to visualize the current and future state of your organization’s activities. At the end of the year, use this year’s budget and review resources to inform next year’s budget, along with your statements of activities and functional expenses and any other cash flow forecasting tools your CFO has access to.

Nonprofit Budget Template & Example

If you’re ready to dive into creating budgets for your nonprofit, there are various templates available online to help you get started. Every organization’s budget will look slightly different, so make sure you can customize your chosen template to fit your needs and goals.

Use our flexible nonprofit budget template to start planning your organization’s finances.

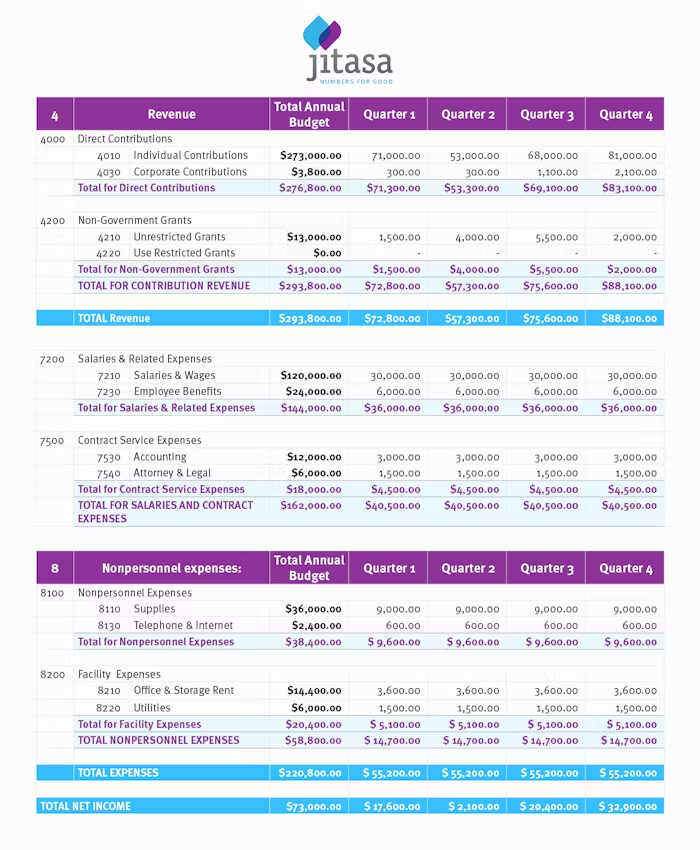

Download for FreeTo give you a taste of what your operating budget may look like when it’s finished, here is a partial example we’ve created:

The best way to ensure your budget is accurate and actionable is to have expert nonprofit financial professionals create it for you—like our team at Jitasa. We work exclusively with nonprofits, so we understand the unique complexities of your organization’s financial situation and can use our experience to develop tailored solutions for your needs.

Budgeting and cash flow forecasting are foundational to our fractional CFO services, plus our bookkeepers and accountants will record and analyze financial data to help keep your spending and fundraising in line with your budget all year long. Best of all, our services are affordable and cater to nonprofits of all sizes and missions!

Well-developed budgets help your nonprofit be financially transparent with its team, board, supporters, and community at large. This accountability—which is at the heart of all nonprofit accounting activities—is essential for instilling trust in all of these individuals and being able to fund your mission for years to come.

For more information on nonprofit financial management, check out these resources:

- Nonprofit Accounting: An Overview & How to Get Started. Explore more essential documents, best practices, and principles to build your foundational knowledge of nonprofit accounting.

- What Is a Fractional CFO for Nonprofits? The Ultimate Guide. Dive deeper into the role of the person who will lead your nonprofit’s budgeting processes and learn why outsourcing the CFO position is a good option for many organizations.

- Free Nonprofit Assessments by Jitasa. Test your knowledge of nonprofit finance and systematically consider your organization’s overall health to inform your budgeting approach.

Develop, analyze and apply your organization’s budgets with expert help from the nonprofit financial professionals at Jitasa.

Request a Quote