Nonprofit Risk Management: How to Safeguard Your Operations

Sunday, October 12, 2025 by Jon Osterburg

When everything is going well at your nonprofit, thinking about potential risks and how to navigate them may seem unnecessary (and scary). However, when those risky situations occur— whether they’re linked to external economic and social turbulence or internal errors—you’ll be much better prepared to handle them if you’ve created a risk management plan during the good times.

In this guide, we’ll cover everything you need to know to get started with nonprofit risk management, including:

- Nonprofit Risk Management FAQ

- How to Conduct a Nonprofit Risk Assessment

- Tips for Effective Nonprofit Risk Management

Risk management impacts every aspect of your nonprofit’s work, from service delivery to donor engagement to financial activities, and it will only become more important as the sector continues to evolve. Let’s dive in!

Develop a financially sound risk management plan with expert help from Jitasa.

Request a QuoteNonprofit Risk Management: Frequently Asked Questions

To help you find your footing with this complex process, we’ll begin by answering some common questions about risk management in a nonprofit context.

What is nonprofit risk management?

The term “risk” refers to the probability that something bad (damage, injury, liability, loss, etc.) might occur due to internal or external circumstances. Therefore, nonprofit risk management is the process of identifying, evaluating, mitigating, and preventing negative situations that could impact your nonprofit.

At times, your organization may choose to venture into uncertain territory and potentially even take risks to build the capacity necessary for growth. In addition to protecting your nonprofit against purely negative situations you didn’t enter into willingly, risk management will also help you keep elective risks in check so they don’t cause harm or hinder your expansion plans.

What risks do nonprofits most commonly face?

Your nonprofit’s risks will likely be slightly different than the risks for-profit businesses have to navigate, and they may also vary based on organization size, vertical, and other related factors. However, some risks that crop up often (meaning your nonprofit definitely needs to be prepared to manage them!) include:

- Cybersecurity violations. Poor data management and misguided online practices can lead to data breaches that expose sensitive information about your organization or its supporters, such as credit card details, bank account numbers, or home addresses. Depending on what data gets leaked, breaches can break donors’ trust in your nonprofit or leave your information vulnerable to other negative incidents.

- Fraud. There are many types of fraud, which can occur intentionally or unintentionally (e.g., accidentally writing a check for the wrong amount). However, one nonprofit-specific type is fraud by impersonation, which occurs when a scammer uses your organization’s publicly available employer identification number (EIN) and branding materials to set up a fake donation page and “fundraise” as if they were your nonprofit while keeping the money for themselves.

- Theft. If your nonprofit’s internal systems are faulty or lower-level employees and volunteers get access to resources they shouldn’t, someone close to your organization could steal its money or technology. Nonprofits tend to be composed of good, trusting individuals, which can make them especially vulnerable to theft.

- Noncompliance. Nonprofits like yours are subject to certain regulations that businesses aren’t. These requirements ensure your organization can remain tax-exempt, solicit donations, and generally make a positive impact. If you don’t follow these rules (e.g., failing to file tax returns on time, not keeping up with state charitable solicitation registrations, or directly endorsing political candidates instead of sticking to issue-based advocacy), you risk losing your nonprofit's 501(c)(3) status and damaging its reputation.

Knowing what problems you might encounter is half the battle in solving them. Use these categories as a starting point, and reach out to an external professional if you need help identifying and managing other types of issues or just want an unbiased perspective on your risks.

Why is risk management important for nonprofits?

Effectively managing your nonprofit’s risks can lead to various benefits, including:

- Safeguarding mission-critical activities, since you’ll be better equipped to continue delivering services despite difficult circumstances.

- Ensuring compliance with legal requirements and other regulations for nonprofits.

- Supporting strategic decision-making by giving leaders a more complete picture of a situation’s possible outcomes.

- Promoting financial health and stability through an increased emphasis on accountability, which is at the heart of strong nonprofit accounting practices.

- Building trust with donors and stakeholders, if you communicate transparently about how you’re navigating setbacks or preventing losses.

- Protecting your nonprofit’s reputation so it doesn’t end up in the news for a negative reason.

You’ll maximize these benefits if your risk management strategy is proactive rather than reactive. Considering what could go wrong during relatively tranquil periods and embedding measures to prevent problems where possible will save your organization time, money, and stress in the long run.

Proactively prevent supporter-related risks with our Donor Privacy Policy Template.

Download for FreeWhat makes a good nonprofit risk management strategy?

In addition to taking a proactive approach, your risk management plan should also be comprehensive and tailored to your nonprofit’s needs. Here are a few elements every strategy should include:

- Clearly defined risks: Explain what the risk is, whether it’s internal or external, how much you can control it, and if it’s inherent to your operations or residual from addressing another issue.

- Categorization and prioritization: Group similar risks and rank them based on likelihood and impact (more on this later!) to make it easier to determine which situations you most need to address and how to do so.

- Preventive measures paired with contingency plans: While preventing risks by adjusting internal operations is extremely useful, it isn’t always possible, so you should also outline the steps for resolving problems once they’ve occurred.

- An emphasis on open communication: Ensuring regular oversight and information sharing between staff, stakeholders, and other parties helps protect against bias and make workflows more efficient.

Of course, these are just a few examples of what you may include in your risk management plan. Your nonprofit’s finalized strategy should align with your mission, operations, and the specific issues your organization is likely to face.

Who is involved in nonprofit risk management?

Risk management should be a team effort, involving input from your:

- Board, which will oversee your risk management plan’s development and implementation.

- Leadership team, who will create the plan and take or delegate the measures that apply to their areas of responsibility.

- Other staff members, who will provide strategy input as applicable and ensure they follow your established best practices in their day-to-day work.

- Financial professionals, who will touch many areas of risk management planning, prevention, and mitigation because many risks eventually come back to funding.

Many organizations create a risk management committee that includes individuals from several of these groups to focus their efforts, and some large nonprofits even hire a full-time risk manager. Taking one of these approaches doesn’t make it any less important for everyone at your organization to be aware of potential risks and how to manage them, though.

How to Conduct a Nonprofit Risk Assessment

Conducting a risk assessment is the preliminary step to developing a risk management plan. There are several ways you can go about doing this, including:

- Evaluating your nonprofit internally: A basic self-evaluation allows your team to review your organization piece by piece and continually ask, “What risks are associated with this aspect of our operations?” Then, you can take appropriate action based on your findings.

- Using a checklist: There are also risk assessment checklists available online, through auditing firms, and in books that your nonprofit can follow to evaluate different types of risks more systematically.

- Recruiting a third party: Professional help can be useful if you’re struggling to create your own risk assessment or want an unbiased, expert perspective on your organization’s situation. If your nonprofit has undergone an independent financial audit in the past, you may start by reaching out to your auditor, since they might also offer risk assessments or know of another firm that could conduct one for you.

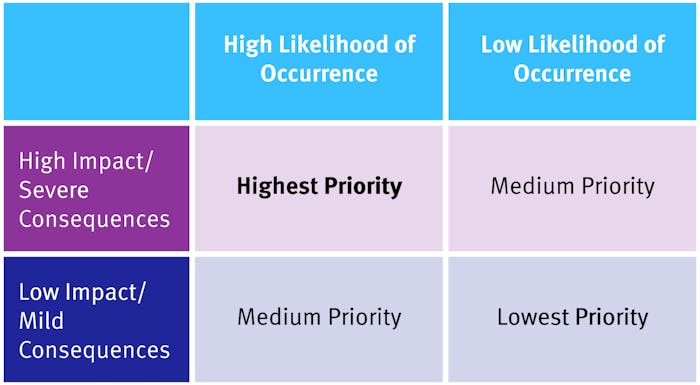

No matter which route you go, make sure your assessment not only identifies and defines potential risks, but also prioritizes them based on how likely they are to occur and how severe the consequences would be if they were left unchecked. That way, you can determine the order in which you need to address risks in your plan, which will probably be as follows:

- Likely situations with major consequences

- Likely situations with minor consequences

- Unlikely situations with major consequences

- Unlikely situations with minor consequences

For example, let’s say your nonprofit already employs some data security precautions like database encryption and two-factor authentication, but your team would like to further strengthen its cybersecurity. Additionally, you’ve been finding it challenging to file your Form 990 on time the past few years.

Although both of these challenges could have serious consequences—breaking key stakeholders’ trust and losing your 501(c)(3) status, respectively—tax noncompliance would be a bigger risk than cybersecurity violations since it’s more likely to occur in your organization’s current position, so you should address the tax issue first and then work on data protection.

Tips for Effective Nonprofit Risk Management

At this point, you’re finally ready to create your nonprofit’s risk management plan! Here are a few tips for making it useful and driving better results:

- Create individual mitigation strategies for each identified risk. As you go down your list of risks, brainstorm a specific way to address each one. Returning to our previous examples, if tax noncompliance is your highest priority risk, you might apply for a Form 990 extension or research outsourced accountants who could do your taxes for you. For your lower-priority cybersecurity risk, you may just quickly check if there are any precautions you haven’t taken (e.g., updating a system or changing user permissions).

- Delegate management duties. Put different people in charge of your top five or so risks to spread out management responsibilities across your organization. When people feel they have ownership over something, they’re more likely to give it their all. Plus, delegation ensures no one is overloaded with risk-related duties.

- Establish ongoing oversight. Whether it’s your board, a separate committee, or a full-time risk manager, someone should ensure risk review becomes an integral part of your operations and check in regularly with task leaders and your legal team to see how things are going. This oversight also makes it easier to launch crisis responses since you’ll already have leaders chosen, which improves efficiency and prevents panic.

- Review policies and procedures. Policies and procedures are a great starting point for preventive risk management. Ensure you have strong financial policies in place for gift acceptance, conflicts of interest, expense reimbursement, and staff compensation, as well as guidelines for other key aspects of operations like technology usage and volunteer management. Publish all policies and procedures in shared handbooks or instructional documents for team members’ easy reference.

- Implement internal controls. Internal controls are smaller guidelines that work alongside your overarching policies and procedures, but they’re specifically designed to prevent risks.

One internal control many organizations use is requiring two team members to sign off on payments over a certain amount. This procedure helps catch financial fraud early (whether intentional or unintentional) and ensures a single individual can’t be held liable if the payment amount is still incorrect after it’s reviewed.

- Consider overall comfort level with risk. Some challenging situations are inevitable when running a nonprofit, and some risks are worth their rewards. Determining how comfortable your organization is with risk can help you make many important decisions, from how to invest your reserve funds to how to balance the trade-off between cost and comprehensiveness in insurance policies.

- Diversify your team. Risky situations often arise when people are too busy to check in with each other, so make sure your organization is adequately staffed. Ensure each person has their own area of expertise, but also that teams collaborate to increase visibility. For example, your finance team might consist of a bookkeeper, accountant, and CFO who all have their areas of expertise (recordkeeping, analysis, and strategy, respectively) but work together on key activities like budgeting and audit preparation.

To that last point, if your nonprofit needs access to specific expertise to ensure adequate staffing but doesn’t have the need or budget for a new full-time staff member in that role, outsourcing is a great option. And if you’re looking to outsource any financial services, you’ve come to the right place!

Our experienced team at Jitasa works exclusively with nonprofits, so we understand the unique risks your organization may face and will work with you to prevent and mitigate the most critical ones to your specific operations as we help you manage your resources effectively. Whether you need bookkeeping, accounting, fractional CFO, or nonprofit controller services, we’ve got you covered—at an affordable rate for organizations of all sizes and missions.

Nonprofit risk management is an ongoing process that requires time and oversight every year. While it may seem tedious, having an effective risk management strategy in place will ultimately save your organization time and money in both the short and long term. Use the strategies above to get started, and don’t hesitate to reach out for expert assistance (especially on the financial side of things, since our team at Jitasa is happy to help!) whenever you may need it.

For more information on managing nonprofit risks and finances, check out these resources:

- Restricted Funds: Everything Your Nonprofit Needs to Know. Discover an important area of nonprofit accounting where risks frequently arise: navigating donor-imposed designations on contributions.

- 12+ Top Nonprofit Accounting Firms & How to Choose One. Explore our top recommendations for outsourced partners to come alongside your nonprofit in its financial and risk management journey.

- Free Nonprofit Assessments by Jitasa. Lay the foundation for risk management by evaluating your organization’s overall health, and test your knowledge of nonprofit accounting and its relationship to navigating risk.

Partner with Jitasa to diversify your team and prevent risks through expert financial management.

Request a Quote