How Do Nonprofits Make Money? Making Nonprofits Profitable

Have you ever really considered what the word “nonprofit” means? Many people know that organizations classified as nonprofits receive benefits like tax exemptions from the government. But if they truly operate without profit, how can the organization function?

Moreover, there is a lot of guidance recommending that nonprofits “operate like businesses.” But if the purpose of a business is to make a profit, what does this guidance actually mean?

These questions and many others are valid, especially if you’re new to the nonprofit world. If you’re considering starting a nonprofit, working with one, or even donating to one, it’s important to better understand what exactly these organizations are and a little bit about how they manage their finances.

In this guide, we’ll cover several key concepts as an introduction to the nonprofit world and the ever-important question: How do nonprofits make money?

Nonprofit Accounting 101 Course

Take a deep dive into some of the basics of nonprofit accounting.

Free CourseTable of Contents

- Defining the Term: Nonprofit

- How do Nonprofits Make Money?

- Maintaining the Nonprofit 501(C)(3) Status

- Budgeting Your Nonprofit’s Money

- How Are Nonprofit Staff Members Paid?

Ready to learn more about the nonprofit sector and how these organizations operate? Let’s get started.

Defining the Term: Nonprofit

Nonprofits are often known for their charitable work, bringing together people who want to work toward something noble.

In a for-profit business, the primary goal is to earn a profit that will be distributed to the owners and shareholders. However, when an organization officially registers to be a federally-recognized nonprofit with federal 501(C)(3) status, they make a promise to reinvest any additional money they make back into the organization itself. In return, they receive a tax exemption.

In non-financial terms, a nonprofit organization is a group of people joining together under a common cause and shared point of view, usually working toward providing a service. In economic terms, it’s an organization that uses surplus revenue to offer more or additional services, for which they are rewarded with tax-exempt status.

Why become a nonprofit?

Nonprofits receive many benefits, especially economic benefits, that may entice an organization to register to become an official 501(C)(3) nonprofit organization. Some of these benefits include:

- Tax-exempt status

- The ability to obtain private or public grants

- A desire to work with an organization that exists as a separate entity from its owner

- Status as a limited liability company (LLC), which prevents founders, members, employees, and directors from being held personally responsible for debts incurred by the nonprofit

However, the most common driving factor for an organization to become a nonprofit is to perform meaningful work that makes a difference in the community and the world.

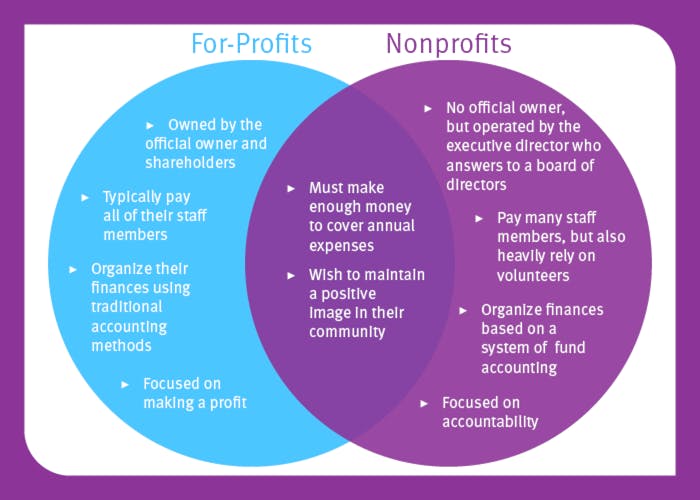

Key Differences Between For-Profit and Nonprofit Organizations

The greatest difference between nonprofit and for-profit organizations is the drive to make a profit. While it’s the primary focus for businesses, it’s not the driving factor for nonprofits. There are other differences in how these two types of organizations operate, however, that are important to take into account.

For-profit organizations:

- Are owned by the official owner as well as shareholders who share the profit of the company

- Typically pay all of their staff members, except occasionally those hired for an internship

- Organize their finances using traditional accounting methods to cover all expenses while still providing a profit for owners and shareholders

Nonprofit organizations:

- Have no official owner, but are operated by the executive director who answers to a volunteer board of directors

- Typically pay many staff members, but also rely heavily on a network of volunteers who help keep the organization running smoothly while sticking to a tight budget

- Organize finances based on a system of fund accounting to ensure all expenses are covered and any restrictions on income are accounted for

Both nonprofit and for-profit organizations must make enough money to cover their expenses and stay afloat. They also both wish to maintain a positive image in the eyes of the public to continue earning money and growing their organizations.

How Do Nonprofits Make Money?

Obviously, nonprofits require money to operate, just as any other business does. Nonprofit organizations must have a reliable income to cover costs related to office space, employee salaries, equipment, marketing, and day-to-day operations — not to mention the services they provide.

There are restrictions on how that money can be made, though, given the organization’s tax-exempt status. Donations, money made from fundraising events, and items sold in the name of fundraising are all fine. And while there are other ways a nonprofit can make money (for example, selling gift baskets that were paid for but never retrieved after a fundraising event), they should be kept to a minimum to avoid losing the tax-exempt status.

Let’s dive deeper into some revenue sources for nonprofit organizations.

Earned Income

While many nonprofits put a great deal of emphasis on donations and fundraising initiatives, these organizations often also make money through earned income. They self-generate funds to contribute to their budget and help the organization stay afloat.

To maintain a 501(C)(3) status, this revenue needs to be directly related to the organization’s mission in order to remain tax-exempt. Earned income can come in many forms, including:

- Sales of merchandise

- Fees charged for services

- Membership fees

- Renting out physical space

Earned revenue streams must be reported differently if they don’t share a direct link with the nonprofit’s mission. Therefore, if you work with an organization that relies on earned income and are unsure of its relevance to your cause, always discuss these avenues with an accountant. They’ll help you determine if it falls within the mission and how to report it properly come tax season.

Individual Contributions

If you’ve ever personally donated to a nonprofit, the organization reported your gifts as individual contributions. Individual donations are contributions to nonprofits from general supporters, mid-tier donors, and major givers.

In addition to the range in donation sizes, individual donations may also look different based on what is contributed, how it’s donated, and what the gift even is. For instance, consider the following types of individual donations:

- Event contributions. Donations made as a part of event registration or donated at your organization’s fundraising events are given by individual donors and are therefore counted in this category.

- Online donations. While it’s easy to think of individual donations as those you solicit via mail or in-person discussions from major donors, the gifts you receive via your online donation page will add up to a significant portion of your individual donations.

- Stock donations. Sometimes, supporters will contribute stock holdings to your nonprofit rather than direct funds. These donations are sometimes made through donor-advised funds and often allow the donor to give more compared to if they sold the stock first.

- Planned gifts. Planned gifts are those promised to nonprofits but paid out at a later date, often in the form of a will or a trust. These gifts are often large and paid out after a donor passes away.

- In-kind contributions. In-kind donations are gifts of items rather than money, but their value must be recorded in your accounting system as donations. They can come either from individual donors or from other organizations.

Nonprofits typically spend a lot of time working to acquire individual donors. They don’t want them to be tempted to take their generosity elsewhere! That’s why nonprofits focus a lot of their efforts on the retention of individual supporters, ensuring they become more and more invested in the cause. Retaining important supporters does wonders to ensure sustainable funds for the future.

Grants

Applying for grants is another important way in which nonprofits make money. Grants are often provided by other organizations to help nonprofits accomplish very specific goals. The grantor needs to make sure that their funding is going to a good cause, that the goal is achievable, and that the interests of the nonprofit align with the mission of the grantmaker. Therefore, your nonprofit needs to consider all of these factors when writing grant proposals.

Some of the organizations that offer grants for nonprofits include:

- Government entities

- Public charities

- Community foundations

- Family foundations

- Private foundations

One of the most important things nonprofits need to consider when applying for grants is the instructions for the application process. Grantors typically require specific guidelines to be met in the proposals submitted by nonprofits, so they need to carefully ensure they’ve met those guidelines and presented a compelling argument for why they deserve the funds.

Grants can present a challenge as nonprofits are managing their finances. Grant funding is often restricted to the project for which the nonprofit has requested the funds. Therefore, they need a method for tracking the funding they use and ensuring that grant funding is only used for the project at hand.

On top of that, nonprofits need to have an effective management system in place to make sure they can report how funding was spent back to the grantor on the right timeline. This means having a detailed calendar to track deadlines for different grants and effective reporting processes to provide necessary information back to the grantmaking organization.

Investments

One way for nonprofits to make money that is not widely used among organizations is investing. A nonprofit can open a brokerage account just like an individual investor can. Even better, their tax-exempt status means that nonprofits may not even have to pay the income tax on portfolio dividends and gains.

When nonprofits invest their money, they’re usually not doing so as a main source of income. However, it can help organizations build assets. The other reason they may invest is to grow long-term savings and bolster their reserve funds.

The most common form of investment for nonprofits is an endowment. This is a specific type of investment, often restricted by a major donor. They generally require the initial donation be invested, but the nonprofit receives the dividends of that account as regular contributions to the organization. This income may or may not be restricted by the donor, but the dividends provide a sustainable source of income for the nonprofit.

Learn more about how nonprofits make and allocate money.

Talk to a Jitasa accountantMaintaining the Nonprofit 501(C)(3) Status

When nonprofits register to become 501(C)(3) organizations, they agree to take certain steps to ensure their compliance with federal regulations in return for their tax-exempt status and nonprofit benefits. Essentially, they’re agreeing to reinvest all of their funding back into the organization rather than taking that money straight to the bank for individual gain.

The federal government has requirements to ensure organizations are not abusing their tax-exempt status and are complying with this agreement. To maintain their tax-exempt status, nonprofits must take the following actions:

- Always filing their annual tax return with the IRS to report on their gross receipts and how they used their funding over the course of the year.

- Acknowledging all donor gifts over $250 by providing a written receipt.

- Maintaining a formal process for managing contractors and compensation agreements with outside and inside employees to ensure that it is in service of the public and not private interests.

- Familiarizing themselves with and adhering to potential restrictions on lobbying to avoid breaking rules or crossing lines.

- Avoiding engaging in political campaign activity that can be construed as favoritism, such as selling mailing lists, renting offices, or paying for political advertising.

- Paying taxes on unrelated business income.

- Asking the right questions when consulting with a lawyer or nonprofit accountant.

Nonprofits that lose their 501(C)(3) status would need to pay taxes on all of the contributions they receive, so it’s an expensive mistake to make. Not only that, but they would also need to register to become an official 501(C)(3) organization again, which also requires the organization to pay a fee.

Budgeting a Nonprofit’s Money

Just like for-profit companies, nonprofit organizations also allocate their money and create budgets. They do their best to stick to this financial plan, which takes into consideration the estimated revenue the nonprofit expects to receive, their anticipated expenses throughout the year, and the restrictions they encounter with donations and grants.

In addition to planning their finances with an annual budget, nonprofits also create income statements (also called statements of activities), balance sheets (also called statements of financial position), and cash flow statements to better analyze the organization’s financial health and habits.

Any surplus that the nonprofit receives is reinvested back into the nonprofit itself, assuming they don’t use it to pay outstanding debts. Additional funds may also be placed into a reserve fund that the organization can use if they run into financial difficulties.

Nonprofit Budget Template

The budgeting process is often times confusing to many nonprofit members and leaders. This nonprofit budget template is designed to alleviate that pain.

Free DownloadHow Are Nonprofit Staff Members Paid?

We’ve reviewed a lot about how nonprofits make money as an entire organization, but what about the staff members and founders? At for-profit companies, the owners of the organization and the shareholders split the profit and take it home. But nonprofits work differently.

Remember that nonprofit organizations have founders--not owners. These founders cannot benefit from the net earnings of the organization, although they can collect a salary. Nonprofits can (and do) try to achieve positive revenue with enough leftovers to save for future operational experiences or emergencies. But the profit is never distributed to an individual or private interest.

Nonprofits also often put in place a compensation policy to help them determine how much top executives will be paid in salary and ensure that amount is in line with other similar organizations. This policy outlines the research process for determining salary thresholds.

Past the compensation policy, many nonprofits focus their efforts on offering a well-rounded compensation policy for their staff members. This means they want to offer additional benefits past the monthly paycheck. They also often offer incentives such as:

- Increased flexibility. Nonprofits are often more flexible about some day-to-day considerations, including work schedules or work-from-home opportunities.

- Better benefits. Nonprofit organizations offer normal benefits for full-time employees (like medical and dental insurance, life insurance, and retirement plans), but they often go above and beyond. Staff members may get opportunities for sabbaticals, tuition reimbursement, or additional vacation time.

- Purposeful work. For many people, the opportunity to do important work in service of others is the main driver for joining the staff of a nonprofit.

- Good community culture. People like working in environments where they feel respected, valued, and useful to their communities and their leadership. Nonprofits tend to develop a positive company culture that keeps people around.

While nonprofits don’t take home profit in the same way a for-profit does, they still allocate some of their regular funding to take care of staff members. Offering a competitive salary along with the additional benefits of working in the nonprofit sector helps nonprofits keep staff members around longer. Retention is essential for nonprofit financial success as hiring to replace lost staff is so expensive.

The bottom line

Nonprofits don’t make a profit in the same way for-profit companies do. Additional funds aren’t provided back to the owner and shareholders. For nonprofits, it’s ultimately about staying out of the red — having enough money to continue providing services, save for a rainy day, and pay their employees a good wage. Although they aren’t driven by the need to put dollars into executive bank accounts, they do require capital to run and generally act in the interest of continuing service through fundraising.

To talk more about how to transition your nonprofit to a more sustainable financial model or simply discuss your financial situation, contact a nonprofit accountant!

If you’re interested in learning more about how nonprofits make money and how they manage their finances, check out these additional resources:

- Nonprofit Financial Management | Best Practices to Know. Once nonprofits have the revenue they’ll use to fund their programs, how do they record it and ensure those funds are used properly? We’ll dive deeper into that question with this article on financial management.

- Restricted Funds: What Are They? And Why Do They Matter? Sometimes, nonprofits receive funds from their supporters, but the supporters restrict those funds so they can only be used for certain projects. Learn more about how that impacts nonprofit finances.

- 4 Types of Donor Analytics and What to Do With Them. Individual donations are a key revenue source for nonprofits, so organizations collect a lot of data about their supporters. See what data they collect and how organizations use this information.

Learn more about how nonprofits make and allocate money.

Talk to a Jitasa accountant