Nonprofit Net Assets: What They Are and Why They Matter

Tuesday, January 13, 2026 by Boyd Orr

A major aspect of effective nonprofit management is knowing whether your organization is financially healthy. After all, your organization’s financial health directly impacts its ability to fulfill its mission, plan for growth, and manage risks.

Nonprofit net assets are a key indicator of financial health. However, there are some complexities to be aware of in their analysis and application. In this guide, we’ll break down everything you need to know about nonprofit net assets, including:

While the basic calculation to determine this metric is fairly straightforward, determining and applying insights about your net assets to your nonprofit’s unique situation can be challenging. For best results, we recommend reaching out to nonprofit accountants like the team at Jitasa. Our expert financial professionals will help you calculate your net assets accurately and apply that calculation to inform your budget, chart of accounts, and financial reports.

Partner with the experts at Jitasa to properly track and report your net assets.

Request a QuoteNonprofit Net Assets: Frequently Asked Questions

What Are Nonprofit Net Assets?

Nonprofit net assets are the financial resources your organization has available to fund its operations and mission-related activities. They include both monetary resources (e.g., cash and investments), as well as non-monetary assets that still have financial value for your organization (e.g., property and equipment).

The difference between your nonprofit’s assets and its net assets is that the term “assets” simply refers to everything your organization owns or controls, while “net assets” also takes into account your liabilities to show what your organization is actually worth. Anything your nonprofit owes—debt, payables, deferred revenue, etc.—is considered a liability.

Net assets are a more accurate measure of your nonprofit’s financial position than total assets because they reflect your obligations and commitments to external parties as well as your organization’s wealth. Reporting your net assets allows you to be more transparent with donors and stakeholders about your nonprofit’s financial situation and make informed decisions about how to allocate available funds at your organization.

What Is the Difference Between Net Assets and Equity for Nonprofits?

In a nonprofit context, “net assets” and “equity” refer to the same concept: the amount of available financial resources under the organization’s control. Your nonprofit’s net assets demonstrate its equity, or the ownership interest it has in financial resources. The main difference between the terms is semantic: nonprofits tend to use “net assets” more often, while for-profit organizations use “equity.”

What Are the Different Types of Nonprofit Net Assets?

Besides the terminology, a key difference between for-profit organizations’ equity and nonprofit net assets is that not all nonprofit net assets should be categorized the same way. In the system of fund accounting that nonprofits use, some funding has specific requirements for how it can be used. Your organization should reflect these restrictions in the way it reports its net assets to remain accountable to the donors who imposed those funding restrictions.

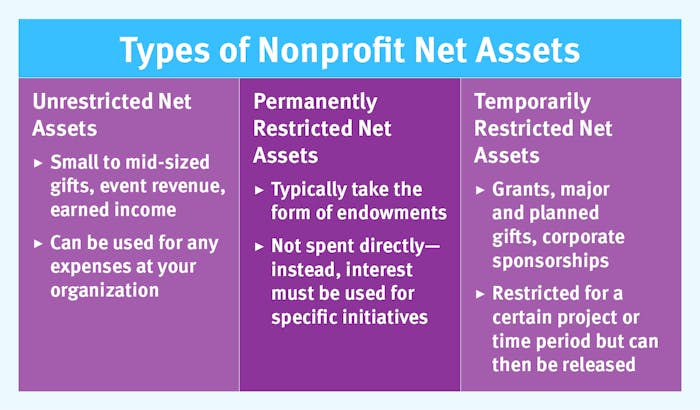

Let’s look at the three types of nonprofit net assets—unrestricted, permanently restricted, and temporarily restricted—in more detail.

Unrestricted Net Assets

Unrestricted net assets are financial resources that have no conditions attached to their use. Instead, your nonprofit can put these funds toward any of its expenses, whether they’re directly related to your mission or part of your organization’s overhead.

Some types of nonprofit revenue that tend to be unrestricted include:

- Small and mid-sized individual donations

- Investment interest and returns

- Corporate giving revenue from programs like matching gifts, volunteer grants, and payroll donations.

- Earned income from sales of merchandise, service fees, membership dues, or renting out your organization’s facilities or equipment

Although these are the most common types of unrestricted funding, be careful as you record and spend them to make certain that there are no obligations associated with them. You should track unrestricted net assets separately from net assets with restrictions so you know how much your nonprofit has to cover its expenses when paying bills or spending money.

Restricted Net Assets

Conversely, net assets with restrictions have to be used for a specific project, program, or other purpose at your nonprofit as stipulated by the donor or grantmaker who contributed the funding. Most restricted contributions are relatively large, and funders want to make sure that you use their money to further mission-related initiatives that align with their interests and values before agreeing to give a significant amount to your organization.

Within the category of net assets with restrictions, there are two additional designations to know:

- Permanently restricted net assets most commonly take the form of endowments. Your nonprofit doesn’t spend these gifts directly but instead places them in an investment account. The money then generates interest, which you’ll put toward a specific program or annual initiative, such as a scholarship fund.

- Temporarily restricted net assets often include grant funding, major and planned gifts, and corporate sponsorship revenue. These assets are restricted either for a specific period of time or until a designated project is completed, at which point any leftover funding may be released from restriction as long as the contributor agrees to it.

In addition to reporting restricted and unrestricted net assets separately, it’s important to consider them separately when creating your nonprofit’s annual operating budget. If you only look at your net assets as a whole, you might accidentally overestimate your organization’s spending capabilities or allocate restricted funds toward expenses they weren’t designated for.

First, exempt any permanently restricted net assets from your calculations, and ensure all projected endowment interest and temporarily restricted net assets are allocated toward the correct programs and projects.

Then, fill in the gaps by allocating your unrestricted net assets to cover your overhead expenses and any outstanding program or project costs. If you find that you don’t have enough unrestricted revenue for all of your expenses, it’s likely time to look for ways to cut costs or revisit your fundraising predictions to see if it’s possible to earn more.

Dive deeper into restricted funds with our FREE course!

Get StartedHow Do I Calculate My Nonprofit’s Net Assets?

To determine your nonprofit’s total net assets, you just have to:

- Add up your organization’s total assets.

- Determine your total liabilities.

- Subtract your total liabilities from your total assets.

From there, subtract the net assets with donor restrictions from your total to separate the two categories.

Use the calculator below to see this breakdown:

Nonprofit Net Assets Calculator

Measures the financial resources you have available to fund your operations and mission-related activities.

Net Assets:

Unrestricted Net Assets:

Again, for support with net asset calculation and application, working with expert financial professionals like the team at Jitasa will be your best bet.

How to Report Nonprofit Net Assets

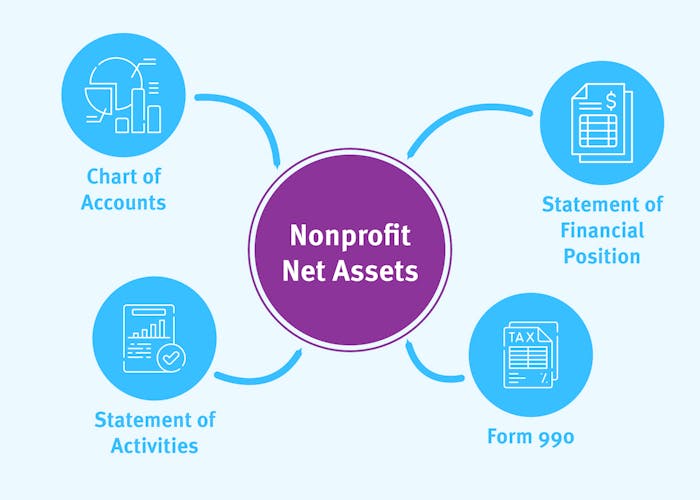

While your nonprofit’s net assets inform the creation of your annual operating budget, budgeting is an indirect application of net assets since you typically won’t use that exact term and number within the document. However, there are several nonprofit accounting resources in which you need to mention your organization's net assets directly, including your:

- Chart of accounts. This document serves as a directory of all of your nonprofit’s financial records. One of the five major categories included in the chart (along with assets, liabilities, revenue, and expenses) is your organization’s net assets, which are broken down further based on restrictions. This chart makes it easy to find where you’re tracking your nonprofit’s net assets in your accounting system whenever you need to reference those numbers.

- Statement of financial position. Also known as a balance sheet, this report is one of the four core financial statements nonprofits compile each year. It outlines your organization’s assets and liabilities before devoting an entire section to net assets (both restricted and unrestricted). By analyzing this statement, you can get an overview of your organization’s financial situation and compare numbers year over year.

- Statement of activities. Another of the core nonprofit financial statements, the statement of activities summarizes your organization’s annual revenue and expenses. It then devotes a section to showing the change in your nonprofit’s net assets from the beginning to the end of the year, as the revenue you brought in will add to your net assets and the expenses you incurred will detract from them.

- IRS Form 990. Whether your organization files its annual tax return using Form 990-EZ, Form 990-PF, or the full Form 990, you’ll need to report your net assets in a few different spots on the form. However, be aware that determining which version of Form 990 to file is based on your organization’s total assets, not its net assets. If your organization has $500,000 or more in total assets, you’ll need to file the full Form 990, even if your net assets are worth less than $500,000.

All of these resources are important for your organization to comply with the Generally Accepted Accounting Principles (GAAP) and government regulations for nonprofits. They’re also useful for internal decision-making, as they show where your organization stands and what it needs to do to achieve financial sustainability and growth. Lastly, when your nonprofit makes information about its net assets publicly available by sharing its tax returns, it builds trust with donors and stakeholders that can lead to increased support.

Your nonprofit’s net assets impact many financial management activities at your organization, so it’s important to understand the concept. Use the calculation and tips in this guide to get started, and don’t hesitate to reach out for professional help with any of the accounting processes that involve reporting your net assets.

To learn more about analyzing and utilizing your nonprofit’s net assets, check out these resources:

- Nonprofit Financial Statements: 4 Essential Reports to Know. Dive deeper into the core nonprofit financial statements, several of which require you to report your organization’s net assets.

- Restricted Funds: What Are They? And Why Do They Matter? Discover the ins and outs of restricted funds, including how to account for them and what challenges and opportunities they pose.

- 12+ Top Nonprofit Accounting Firms & How to Choose One. Explore our top recommendations for outsourced nonprofit accounting services to help your organization understand and apply the concept of net assets.