Getting Started With Nonprofit Bookkeeping: A Complete Guide

Monday, July 8, 2024

As with most decision-making processes at your nonprofit, financial management is most effective when it’s data-driven. Keeping clear records of your organization’s finances allows you to develop analysis, planning, and reporting procedures that lead to greater efficiency and sustainability. This is accomplished through a process known as nonprofit bookkeeping.

If you aren’t sure where to start with nonprofit bookkeeping, you’ve come to the right place! In this guide, you’ll learn all you need to know about bookkeeping for nonprofits, including:

- What is Nonprofit Bookkeeping?

- Why is Nonprofit Bookkeeping Important?

- Core Nonprofit Bookkeeping Duties

- How to Hire a Nonprofit Bookkeeper

Not only is nonprofit bookkeeping different from its for-profit counterpart, but a bookkeeper is just one of the professionals you should have working on your organization’s finances. Let’s begin by clearing up these points of confusion and ensuring we’re all on the same page about what bookkeeping is.

Simplify your nonprofit’s bookkeeping by partnering with the experts at Jitasa.

Request a QuoteWhat is Nonprofit Bookkeeping?

Nonprofit bookkeeping is the process of systematically recording, organizing, and tracking a nonprofit’s financial activities. It allows your organization to monitor its spending, fundraising, assets, receivables, payables, and other transactions essential to its operations.

Naturally, the job of recording and managing financial data falls to your nonprofit bookkeeper. This position is one of the four key nonprofit financial roles—the other three are your:

- Treasurer, who provides financial oversight for your organization

- Chief financial officer (CFO), who takes the lead on strategy and goal-setting

- Accountant, who is responsible for analyzing and reporting financial information

Since your treasurer is typically a member of the board of directors and your CFO works closely with the rest of your executive leadership team, their roles are fairly easy to distinguish. However, your bookkeeper and accountant are both professionals below the executive level who work with financial data in distinct ways. Because of this, bookkeeping and accounting are frequently confused—let’s dive deeper into the differences between them.

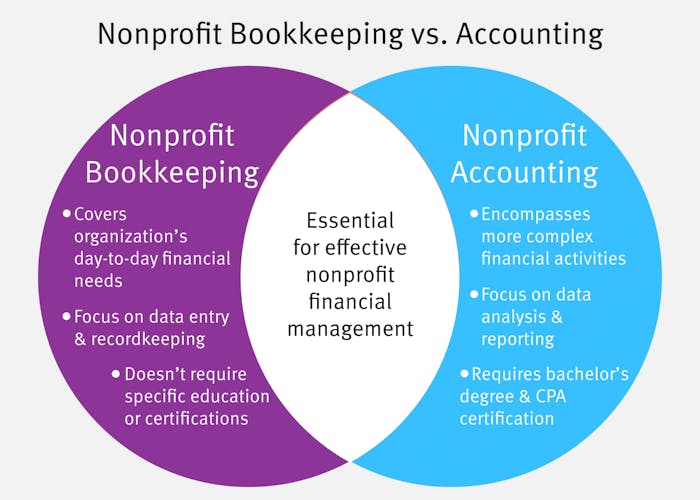

The Difference Between Nonprofit Bookkeeping and Accounting

Bookkeeping covers your nonprofit’s day-to-day financial needs, mostly concerning data entry and simple transactions (more on these duties to come!). Although bookkeepers need some on-the-job training and financial know-how to do their jobs well, they aren’t required to have specific degrees or certifications.

Accountants, on the other hand, need at least a bachelor’s degree in accounting or a related field and a CPA certification to do their jobs well. This is because accounting encompasses more complicated financial duties, such as:

- Reviewing and reconciling various types of transactions

- Compiling financial statements

- Filing tax forms

- Analyzing budgets

- Preparing for audits

The relationship between bookkeeping and accounting is that bookkeeping lays the foundation for the accounting processes that follow it. Once your bookkeeper records financial data, your accountant will base their analytical work and reports on that information.

Learn more about your accountant’s responsibilities in our Beginner’s Guide to Nonprofit Accounting.

Download for FreeWhy is Nonprofit Bookkeeping Important?

Besides informing your accounting practices, your nonprofit can experience multiple benefits by prioritizing effective bookkeeping, including:

- Compliance with legal and regulatory standards. Clean, organized financial data makes it much easier to meet the operational and reporting requirements that federal and state governments have set forth for nonprofits. Both for-profit and nonprofit organizations in the United States also have to follow the Generally Accepted Accounting Principles (GAAP) in their financial management, and bookkeeping especially helps with adherence to the principles of regularity and consistency.

- Data-driven decision-making. As mentioned earlier, bookkeeping provides a resource for your whole team to use when solving problems that involve financial information, from developing overarching goals for your strategic plan to setting fundraising campaign targets to determining how to cut expenses when necessary.

- Increased transparency. Having a centralized reference point for all of your financial data also promotes accountability internally and externally, which is the core purpose of all nonprofit financial management activities. If a staff member, board member, or donor ever has a question about how your organization manages its finances, your records will allow you to answer them accurately.

While small organizations can often manage their bookkeeping activities in a spreadsheet, mid-sized to larger nonprofits will likely need to switch to specialized accounting software to fully experience these advantages. Since these solutions often limit user permissions for security reasons, create open lines of communication between your financial professionals and the rest of your staff so everyone can receive the data they need quickly and easily.

Core Nonprofit Bookkeeping Duties

Generally speaking, your bookkeeper will step in to keep records whenever funds change hands or new financial data is created. To give you a better idea of how this works in practice, here is an overview of six of the main activities associated with bookkeeping for nonprofits:

- Entering basic data. Whether your nonprofit uses spreadsheets or accounting software to track its transactions, your bookkeeper will record the revenue your organization brings in and the expenses it incurs within the system. In most cases, they’ll only handle single-entry data (debit or credit values, not both), and your accountant will come in after them to balance transactions that require a double-entry tracking format (such as in-kind donations, payables, and receivables).

- Writing checks. For most day-to-day payments like rent, utility bills, and vendor payments, your bookkeeper will either be responsible for sending off the physical check or verifying that an automated bank transfer took place. Many nonprofits have internal controls that require payments over a certain amount to receive signed approval from leadership, which your bookkeeper will ask them for if necessary.

- Making bank deposits. Overseeing the depositing of funds into your nonprofit’s bank accounts (whether they come in electronically or via a paper check) also falls under the bookkeeper’s domain. They’ll keep detailed records of these deposits, and your accountant will then serve as a second set of eyes to compare the internal data to your organization’s bank statements and ensure there are no discrepancies or errors.

- Managing invoices. This bookkeeping duty can go two ways. If your nonprofit provides paid services—whether it’s a core aspect of your mission or a one-time instance like renting out your facility for another organization’s event—your bookkeeper will format and send out invoices to those who owe you money. Or, if your nonprofit receives invoices from contractors (such as fundraising consultants or freelance web designers), your bookkeeper will pay, file, and record them.

- Processing payroll. Most large nonprofits have their human resources professionals handle payroll along with other employee-focused tasks like compensation-setting and recruitment. Since small to mid-sized organizations typically have less capacity in their HR department (if they have one at all), they often allow this responsibility to fall to their bookkeeper instead.

- Allocating costs. At a big-picture level, expense allocation is mostly associated with budgeting, which your accountant and CFO will primarily handle. However, your bookkeeper needs to be trained in some basic allocation practices to ensure the right revenue is used for each expenditure, especially when it comes to managing restricted funds.

Every organization has different financial needs, so the exact activities that are considered “bookkeeping duties” will vary from nonprofit to nonprofit. Use the responsibilities listed above as a starting point when creating a role description for your bookkeeper, then consult with your team to add and remove tasks from the list so it’s customized to your organization.

How to Hire a Nonprofit Bookkeeper

If your nonprofit is just getting started with bookkeeping, you may not have the resources or level of need to bring on a new team member to fill that position. Small organizations can often keep effective records by incorporating bookkeeping duties into the role of the existing staff member with the most financial knowledge or asking a trusted volunteer to serve as the bookkeeper.

However, as your organization grows and its financial data becomes more complex, you’ll likely need to hire a bookkeeper—whether on a full-time, part-time, or outsourced basis. Once you’ve determined which of these routes you’ll take, follow these steps to find the right bookkeeper for your nonprofit:

- Develop a clear role description. The responsibilities you’ve determined your bookkeeper needs to cover will form the basis of this description, although you should also include your nonprofit’s values to attract candidates who align with them. Consider your outsourcing budget or the new employee’s compensation plan at this stage as well. Post a formal job description online if you’re hiring in-house, or use these talking points to guide your initial communications with outsourced professionals.

- Do your research. Expand your search for an in-house bookkeeper by sharing the job description on networking sites like Indeed or LinkedIn, where you can also reach out to individual candidates who may be a good fit for your organization based on their profiles. If you’re outsourcing, look up nonprofit bookkeeping firms in your area on Google, evaluate their services and pricing pages, and read reviews from their other clients.

- Interview your top candidates. While interviews are usually associated with hiring, it’s also helpful to set up an in-person or phone conversation with someone at each of the outsourced bookkeeping firms you’re considering so you can get a sense of whether they would work well with your team. Make sure to ask about the depth of their knowledge and experience with nonprofits to confirm that they

- Make your final decision. Assess everything you’ve learned through your research and interviews, then send an offer letter to your top candidate or establish a contract with your chosen firm.

If you outsource your bookkeeping needs, consider choosing a firm that also does accounting so you can have a wider range of financial needs met by one expert team for a single price. At Jitasa, our mission is to do just that—improve the efficiency and effectiveness of nonprofits through our affordable, tailored bookkeeping and accounting services. We’ve helped more than 1,500 organizations take their recordkeeping and analysis to the next level, and we’re prepared to work with your nonprofit no matter what financial challenges you might face!

As your nonprofit gets started with bookkeeping, remember that your goal in financial management should always be to further your mission. Use your past records to strategize ways to continuously improve your organization’s fundraising and service delivery. Additionally, consider outsourcing your bookkeeping needs to give your team more time to focus on making a difference in the community.

For more information on nonprofit bookkeeping and financial management, check out these resources:

- How to Set up QuickBooks for Nonprofits: The Complete Guide. Discover how to get started with the most popular accounting software for nonprofits, QuickBooks Online, so your bookkeeper has everything they need to record your organization’s financial data.

- Cash vs. Accrual Accounting for Nonprofits: The Basics. Which of the two primary accounting methods your nonprofit uses will determine the timing for entering financial information into your bookkeeping system—learn more in this guide.

- Bookkeeping and Accounting Services Exclusively for Nonprofits. Explore Jitasa’s core bookkeeping and accounting offerings, which cater to nonprofits of all sizes and missions.

See how Jitasa’s affordable, tailored bookkeeping and accounting services can work for your nonprofit.

Request a Quote