Cash vs. Accrual Accounting for Nonprofits: The Basics

Tuesday, January 16, 2024

If you work at a nonprofit, you’ve likely noticed that money moves in and out of your organization frequently, whether through revenue-generating activities like running fundraising campaigns and securing sponsorships or spending on your programs and administrative needs.

It’s important to carefully track all of these transactions so you can ensure you’re using your funding effectively to further your mission, which is where nonprofit accounting comes in.

While every organization needs to have some kind of accounting system in place, not all nonprofits approach accounting the same way. There are two main accounting methods you can choose from to keep track of your nonprofit’s funds: cash accounting and accrual accounting.

In this guide, we’ll break down each of these accounting methods and compare them to help you decide which one your organization should use. Here is what we’ll cover:

- Cash vs. Accrual Accounting: What’s the Difference?

- Benefits of Cash Accounting & Accrual Accounting for Nonprofits

- Which Accounting Method Is Right for My Nonprofit?

Let’s dive in with an overview of how each accounting system works in the context of nonprofit organizations.

Work with the experts at Jitasa to set up your nonprofit accounting system.

Request a QuoteCash vs. Accrual Accounting: What’s the Difference?

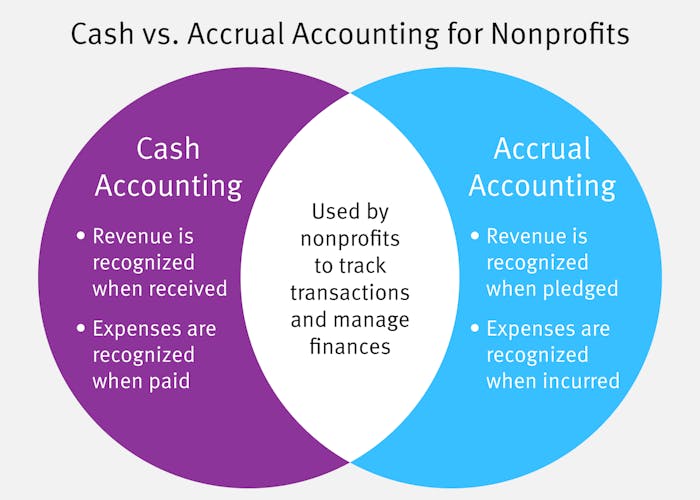

Cash accounting and accrual accounting are both systems that nonprofit organizations use to track their transactions. The difference is in the timing of when you recognize your nonprofit’s revenue and expenses.

In a cash accounting system, your organization will recognize revenue when it’s received and expenses when they’re paid. Essentially, this method tracks the flow of cash in and out of your organization.

With accrual accounting, you’ll recognize revenue when it’s pledged and expenses when they’re incurred, regardless of whether you’ve received or spent the money at that time. This method focuses on your nonprofit’s financial commitments—both what supporters and stakeholders owe to you and what you owe to external parties.

To understand the difference between these systems, let’s say your nonprofit is planning its annual walk-a-thon fundraiser, which will be held next March. Following past event timelines, you open registration and launch your peer-to-peer campaign this December so participants can start collecting pledged donations to be fulfilled after the walk-a-thon. You also put down a deposit to rent tents, tables, and chairs and agree to pay the outstanding balance when you pick them up the day before the event.

If your nonprofit uses the cash accounting method, you’ll wait to record all of the pledged donations from the peer-to-peer campaign until you receive the money in March, so they will all count toward next year’s revenue totals. For the supply rental, you’ll count the deposit toward this year’s expenses and the outstanding balance toward next year’s, depending on which year you make the payment.

If you use the accrual method, you’ll record any peer-to-peer campaign pledges made in December under this year’s revenue totals, and donations pledged from January onwards will count toward next year’s. Because you committed to pay for the supplies this year, you’ll record the full amount of the rental (both the deposit and the outstanding balance) under this year’s expenses.

Benefits of Cash Accounting & Accrual Accounting for Nonprofits

Nonprofit accounting isn’t a one-size-fits-all situation, and different methods have their benefits and drawbacks. To help you figure out whether your organization would be better served by a cash accounting system or an accrual accounting system, let’s break down the advantages and disadvantages of each.

Cash Accounting Method

The main benefit of cash accounting is its simplicity. As previously mentioned, cash accounting is dependent on the cash flow in and out of your organization. So, the system already aligns with your organization’s cash transactions, making it easy to implement and understand even if you’re just getting started with nonprofit accounting. Plus, you can track cash transactions in a spreadsheet if your organization isn’t in a position to invest in accounting software yet.

However, there are several notable drawbacks to the cash accounting method, including that:

- It doesn’t comply with nonprofit reporting requirements. If you fill out your nonprofit’s annual Form 990 based on data from the cash accounting method, you’ll need to note it in a disclaimer. Cash accounting also isn’t in line with the Generally Accepted Accounting Principles (GAAP).

- It doesn’t include tracking for assets, accounts receivable, or accounts payable. These financials are associated with commitments rather than cash flow, so the basic cash accounting system doesn’t account for them.

- It’s less useful for future planning. When you don’t have a record of expected revenue and outstanding liabilities, it’s difficult to pinpoint your exact financial position, which is essential to develop multi-year strategic plans for your organization.

Nonprofits that are just starting out may be able to get by on the cash accounting method. However, once their financial situations become more complicated, they’ll either need to modify the system to include tracking for assets, receivables, and payables or switch to the accrual method.

Accrual Accounting Method

Once nonprofits’ financial situations become complex in any way, they often find the accrual accounting method to be more suited to their needs. Some of its benefits include:

- GAAP compliance. Because these standards call for transparency and full disclosure of financial information for organizations, a more thorough accounting system like the accrual method would be in line with them.

- More accurate reporting. Besides not having to include the disclaimer on your Form 990, your nonprofit will also have a more complete picture of your finances to show grantmakers and auditors.

- Better financial planning. This complete financial dataset will also be useful in creating budgets, setting financial goals, and developing long-term strategic plans for your organization.

- Increased transparency. The core of nonprofit accounting is accountability, and accrual accounting makes it easier to be accountable to your supporters about how you plan to use all of their contributions (both realized and pledged) to further your mission.

The main drawback of the accrual accounting method is that it’s more complicated than the cash method. You’ll likely need specialized accounting software to correctly track all of the different accounts and transactions covered by this system, and it’s more difficult to navigate and analyze this information. Fortunately, there are plenty of resources available to help you get started.

Learn financial basics in The Beginner’s Guide to Nonprofit Accounting.

Download for FreeWhich Accounting Method Is Right for My Nonprofit?

In many cases, very small nonprofits find the cash accounting method to be a good starting point as they take their first steps into financial management. Even if you aren’t able to invest in accounting software yet, it’s still important to have some kind of system in place to track your organization’s early expenses and funds raised.

When your nonprofit acquires its first long-term assets like investment accounts or property, or payables and receivables start becoming part of your day-to-day operations, it’s a good idea to transition to a modified cash accounting system. This means that you’ll record assets, payables, and receivables similarly to the way you would in accrual accounting while still tracking daily transactions on a cash-flow basis.

However, once your nonprofit is considered mid-sized or larger, you’ll almost certainly need to switch to accrual accounting. Here are some of the signs that you may want to make the transition:

- You’re dealing with a larger volume and wider range of transactions than you feel like you can accurately record in a cash accounting system.

- You’re planning a long-term project like a capital campaign that will require you to track many types of expenses and contributions throughout its duration.

- You’re required to conduct a financial audit and are trying to make the process go as smoothly as possible.

- You’re considering applying for more competitive grants where the funders want to see accurate details of your organization’s financial situation.

- You want to make better financial decisions as you plan for growth at your nonprofit.

Even if your nonprofit is still on the smaller side, you might go ahead and set up an accrual accounting system once you have the resources to invest in accounting software and professional help. Beginning to work with a nonprofit accountant on your accrual system early (such as the team at Jitasa!) can prepare you to manage more complex financial records as your organization grows.

Whether you use the cash or accrual accounting system to track your nonprofit’s funds, remember that your ultimate goal is to ensure that your organization’s finances further its mission. Your operational efficiency, fundraising capabilities, and ability to deliver services to your beneficiaries are all dependent on having a well-organized accounting system. So, make sure to choose the right method for your nonprofit, and don’t hesitate to reach out to expert nonprofit accountants with any questions.

To learn more about getting started with nonprofit accounting, check out these resources:

- Fund Accounting 101: The Basics and Best Practices. Dive deeper into the complexities of fund accounting, the type of accounting unique to nonprofits that can be supported by either the cash or accrual method.

- Nonprofit Chart of Accounts: How to Get Started + Example. Discover a key nonprofit accounting resource that is especially important for tracking all of the types of transactions involved in an accrual system.

- Outsourced Accounting for Nonprofits: Top 10+ Firms. Explore our top picks for nonprofit accounting firms that can help your organization set up its accounting system for the first time or make the switch from cash to accrual accounting.