Nonprofit Statement of Cash Flows: Ultimate Guide + Example

Wednesday, June 12, 2024

Do you know how much money you spent last month? What about your household’s net income? If you don’t, you aren’t alone—about 65% of Americans aren’t aware of their monthly spending amounts, and 84% of those who have a monthly budget report exceeding it.

While it’s important for individuals to understand their expenses and income for personal financial stability, it’s even more critical for nonprofits to know where their money is going and coming from. Effective financial management can make or break your ability to further your organization’s mission, and tracking cash flow is a foundational part of an effective management strategy.

Fortunately, there is an accounting tool designed to help your nonprofit with this process: the statement of cash flows. In this guide, we’ll cover everything you need to know about this report, including:

- What is the Nonprofit Statement of Cash Flows?

- Types of Nonprofit Cash Flow

- Applications of the Nonprofit Statement of Cash Flows

- Nonprofit Statement of Cash Flows Example

Let’s get started by defining what the nonprofit statement of cash flows is and how it fits into the bigger picture of financial reporting.

Work with the experts at Jitasa to create and analyze your nonprofit’s statement of cash flows.

Request a QuoteWhat is the Nonprofit Statement of Cash Flows?

The nonprofit statement of cash flows is a financial report that shows how cash moves in and out of your organization. It breaks down all of your nonprofit’s transactions into the categories of operating, investing, and financing activities.

Similarly to other financial statements, it summarizes the data stored in your organization’s accounting system so it’s easier to interpret. Most nonprofits compile this report on a monthly basis, since it helps keep their spending and revenue generation aligned with their annual operating budgets.

Other Nonprofit Financial Statements

The statement of cash flows is one of the four core financial statements your organization is required to compile to maintain compliance with the Generally Accepted Accounting Principles (GAAP) and legal requirements for nonprofits. The other three statements are the:

- Statement of activities. The nonprofit parallel to the for-profit income statement, this report outlines your organization’s revenue, expenses, and change in net assets to assist with the budgeting process.

- Statement of financial position. Also known as a balance sheet, this statement breaks down your assets, liabilities, and net assets to provide a snapshot of your nonprofit’s financial health and help you plan for growth.

- Statement of functional expenses. The only financial statement unique to nonprofits, this report categorizes your organization’s expenses into program, administrative, and fundraising costs so you can see how your spending is furthering your mission.

Most organizations compile the three reports above annually rather than monthly like the statement of cash flows. Additionally, the statement of cash flows is used by for-profit and nonprofit organizations alike, all of which refer to it using similar terminology (statement of cash flows, cash flow statement, or cash flow report).

Set guidelines for creating financial statements with our Nonprofit Financial Reporting Policy Template.

Download for FreeTypes of Nonprofit Cash Flow

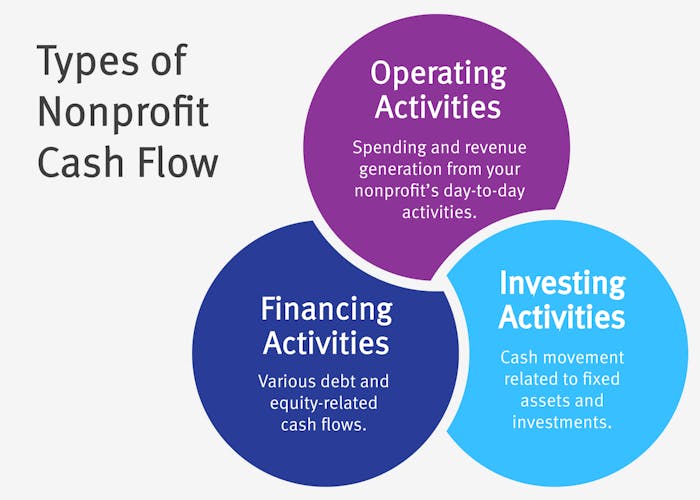

As mentioned previously, the nonprofit statement of cash flows is divided into three main sections: cash flows from operating, investing, and financing activities. Let’s look at each of these elements in more detail.

Cash Flows From Operating Activities

This section describes the cash your nonprofit brings in and spends on the majority of its day-to-day work. Cash outflows from operating activities include:

- Most expenses related to your organization’s programs

- The upfront costs of running fundraising campaigns and events

- Variable administrative costs such as staff compensation and utility bills

On the flip side, cash inflows from operating activities include most of your nonprofit’s major revenue sources, such as:

- Individual monetary donations of all sizes

- Corporate philanthropy contributions like matching gifts and fiscal sponsorships

- Earned income like merchandise sales and membership fees

- Government and foundation grants

In-kind donations and sponsorships typically aren’t noted on the statement of cash flows. This is because gifts of goods, services, and immaterial assets result in a net zero gain in cash for your organization.

Cash Flows From Investing Activities

This category includes all cash movement related to your nonprofit’s long-term assets, such as property, equipment, and investments. Cash outflows from investing activities include:

- Purchasing new property, equipment, or other fixed assets

- Spending money on improvements to existing fixed assets (such as renovating or expanding a building)

- Investing reserve funds in new vehicles like stocks, bonds, money market mutual funds, and cryptocurrency

Cash inflows from investing activities most often include:

- Proceeds from sales of fixed assets

- Interest or dividend payments earned on investments

Investments and their returns often create relatively small cash flows compared to your nonprofit’s other revenue streams, while changes in fixed assets are typically large but infrequent. However, it’s still important to track your organization’s cash flows from investing activities since they affect its long-term financial health and ability to grow.

Cash Flows From Financing Activities

This section describes cash movement related to your organization’s capital structure, most of which concerns debt. Examples of cash outflows from financing activities include credit card and loan payments, while cash inflows from financing activities might look like proceeds from loans made to other organizations and lines of credit.

Some contributions designated for growing your nonprofit’s capital may also fall under your cash inflows from financing activities, particularly endowment funds. However, endowments often bridge all three categories of cash flows. The returns they generate are considered cash inflows from investing activities. Distributions from them are categorized as cash outflows from investing activities or operating activities, depending on whether you spend them on assets or programs.

Applications of the Nonprofit Statement of Cash Flows

Your nonprofit’s statement of cash flows provides a close-up analysis of its spending and fundraising habits. However, this report also has other applications in the bigger picture of accounting. Here are a few of the most common applications:

- Calculating cash flow metrics.Your accountant will likely use your statement of cash flows to determine your organization’s free cash flow (the level of financial flexibility you have to fund growth initiatives) and cash flow to debt (how much cash you have on hand to service any debt you may carry).

- Developing future operating budgets. Understanding how money moves in and out of your organization month-to-month helps account for variability in revenue and expenses. For example, your cash flow reports might show that you bring in the most revenue from late November through the end of December due to your year-end giving campaigns, but you incur extra fundraising expenses in October and early November as you plan those initiatives. Then, you can note those differences in your budget.

- Informing treasurer reports.When your nonprofit’s treasurer creates monthly financial reports for the board of directors, the main point they’re trying to make is how your organization’s cash balance changed from the beginning to the end of the past month. So, they’ll likely refer to that month’s cash flow statement as they develop their report.

- Filing tax returns.In addition to your statement of activities, you can refer back to all of your statements of cash flows from a given year as you report your nonprofit’s revenue and expenses via IRS Form 990.

- Creating annual reports. Most nonprofit annual reports include a financial summary, which you can again use your cash flow statements from the past year to inform. You might also compile all of them into a summary cash flow statement for the whole year and attach that as an appendix to your annual report in case some donors want to learn more about your financial situation.

- Preparing for audits. If your nonprofit undergoes an independent financial audit, your auditor will likely ask you to pull several statements of cash flows so they can review and make recommendations based on them.

Pro tip: Working with a nonprofit accountant (like the experts at Jitasa) is the best way to ensure you’re understanding and leveraging your organization’s cash flow statement in the best possible ways for your unique situation.

Nonprofit Statement of Cash Flows Example

To help you visualize what your nonprofit’s statement of cash flows might look like, we’ve included a basic example here:

Since this report will look slightly different for every organization, reaching out to an accountant is also the best way to ensure your nonprofit has accurate, comprehensive cash flow statements to reference. Our team at Jitasa has worked with more than 1,500 nonprofits in all verticals across the United States, so we have the experience and knowledge to help your organization create, analyze, and apply its financial statements to achieve its goals.

The nonprofit statement of cash flows is an integral accounting report that your organization should take great care to compile and leverage in your day-to-day work. Use the guidelines and tips above as a starting point, and don’t hesitate to contact an accountant if you have questions or want to take your report creation and analysis to the next level.

For more information on nonprofit financial reporting, check out these resources:

- Nonprofit Chart of Accounts: How to Get Started + Example. Your nonprofit’s chart of accounts is an essential resource that informs your cash flow statements. Explore its structure, purpose, and maintenance in this guide.

- Nonprofit Financial Statements: 4 Essential Reports to Know. Dive deeper into everything the four core nonprofit financial statements entail and how they work together to inform your organization’s strategy.

- Fractional Nonprofit CFO Services | Jitasa Group. Learn about the additional cash flow-related services we offer through the Jitasa Strategic Advisory Team (J-SAT), including forecasting, benchmarking, and data visualization.

Accurately track and analyze your nonprofit’s cash flows by partnering with the accountants at Jitasa.

Request a Quote