Form 1099 for Nonprofits: How and Why to Issue One

Tuesday, December 17, 2024

Partner with Jitasa’s expert nonprofit accountants to issue 1099s correctly and efficiently.

Request a QuoteMany nonprofits have two different types of professionals working for them: employees and contractors. Employees are on your organization’s recurring payroll and have well-defined, consistent roles, while contractors provide a specialized service for your organization on an as-needed basis. This role distinction not only impacts how work gets done at your nonprofit—it also makes a big difference when it comes to tax season.

At the end of every year, you’ll provide each of your nonprofit’s employees with a W-2 to help them file their taxes. However, if you’ve worked with contractors, you may need to issue a 1099 to them instead.

In this guide, you’ll learn everything you need to know about 1099s for nonprofits, including:

- What is Form 1099?

- Why Do Nonprofits Need to Issue 1099s?

- How Does my Nonprofit Issue Form 1099?

- What is the Timeline for Issuing Nonprofit 1099s?

Jitasa accountants prepare more than 20,000 Form 1099s for nonprofits every year! While professional accounting services like ours save your team time and ensure your organization’s forms are filled out correctly, it’s still important for you, as a nonprofit professional, to understand what these forms are and how they’re used. Let’s get started!

What is Form 1099?

IRS Form 1099 is a tax form used to prepare and file income information that is separate from wages, salaries, or tips. Nonprofits like yours need to issue this form when you contract individual workers and vendors to complete work for your organization.

There are two types of 1099s you should be aware of: Form 1099-NEC (Nonemployee Compensation) and Form 1099-MISC (Miscellaneous Information). Your organization will typically use Form 1099-NEC when working with independent contractors or freelancers and Form 1099-MISC with other types of vendors. However, these forms are easily confused, so if you have any questions, ask an accountant.

A Note on Contracting for Nonprofits

Many types of nonprofit work don’t need to be completed by brand-new internal employees. Of course, hiring is essential if you want to grow your organization, but you should be strategic about when and why you hire new staff members. Recruiting, onboarding, and keeping up with compensation, benefits, and retention strategies can quickly become expensive.

If you don’t have quite enough work to warrant hiring a new employee, contracting might be the best answer for your organization. This is especially true when you only need extra help for one particular project. For instance, you might contract a web developer to redesign and relaunch your nonprofit’s website or a construction company to renovate your facility.

Once you decide to partner with a contractor, securely store all of the information regarding the work they did for your organization and the payments you issued to them, as well as the W-9 they completed for you at the beginning of your relationship (more on this later!). This data will be useful if and when you need to issue 1099s.

Why Do Nonprofits Need to Issue 1099s?

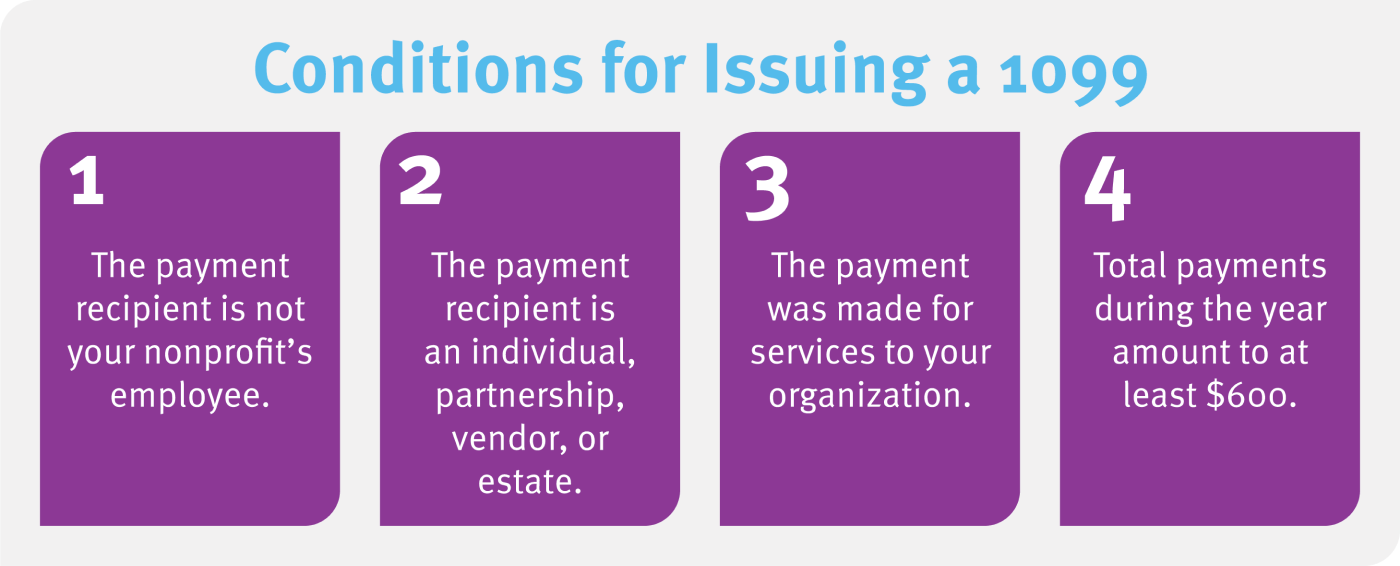

Generally speaking, you’ll need to issue Form 1099 when the following four conditions are met:

- The payment recipient is not your nonprofit’s employee.

- The payment recipient is an individual, partnership, vendor, or estate.

- The payment was made for services to your organization.

- Total payments during one calendar year amount to at least $600.

For example, let’s say you contracted a graphic designer to create marketing materials for your nonprofit’s GivingTuesday campaign. They worked for your organization from August to November of this past year, and you paid them $5,000 over that time frame. In this case, you would definitely need to issue a 1099 for that individual to remain tax compliant. They’re an individual who isn’t your employee, and they provided a service to your nonprofit that you paid more than $600 for in one calendar year.

Along with understanding when you should issue a 1099, it’s equally important to know when it isn’t required. For example, in the case of scholarships or fellowship grants, you won’t need to issue a 1099. These funding sources are considered wages, which means you should complete IRS Form W-2 for the recipient instead.

Other payments for which Form 1099-NEC and 1099-MISC are not required include:

- Most payments to corporations (although there are always exceptions)

- Payments for merchandise, computers, storage, and similar items

- Reimbursements for

- Wages paid to employees (report on Form W-2)

- Military differential wage payments made to employees while they are on active duty in the Armed Forces or other uniformed services (report on Form W-2)

- Business travel allowances paid to employees (report on Form W-2)

- Cost of current life insurance protection (report on Form W-2 or Form 1099-R)

- Payments to tax-exempt organizations, including tax-exempt trusts (IRAs, HSAs, Archer MSAs, and Coverdell ESAs), the United States, a state government, the District of Columbia, a U.S. possession, or a foreign government

Form 1099 may seem a bit confusing at first glance. However, if you follow the four guidelines listed above, it should be easy to determine when it’s appropriate for your nonprofit to issue that form. (And, of course, you can reach out for professional advice if needed!)

Partner with Jitasa’s expert nonprofit accountants to issue 1099s correctly and efficiently.

Request a QuoteHow Does my Nonprofit Issue Form 1099?

To issue 1099s properly, your nonprofit needs to accurately track all payments to contractors using robust bookkeeping systems. However, your organization won’t have all of the necessary information without the contractor’s input. Before you begin filling out any of your nonprofit’s 1099s, you have to ask each of your contracted workers to provide you with a W-9.

What is a W-9 and how does it relate to Form 1099?

IRS Form W-9 is a simple form that you ask contracted workers to fill out so you have the information you need to issue them a 1099. It also allows the IRS to match up each Form 1099 that you report with the right contracted individual’s tax returns.

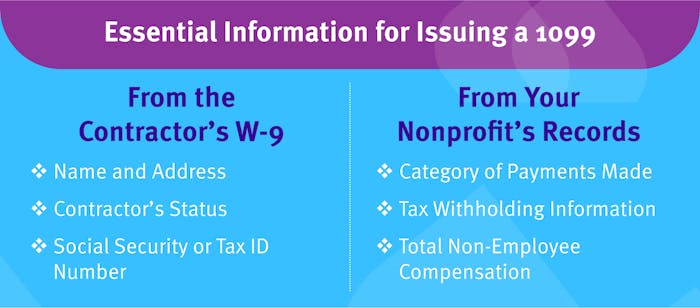

Form W-9 is only one page long, and it asks for the following information:

- Business and/or individual’s name and address

- Contractor’s tax status

- Social Security Number (for sole proprietorships and individuals) or Tax ID Number (for applicable business entities)

We recommend asking contracted workers to fill out their W-9 at the beginning of your working relationship with them. This will save your organization time and energy when it comes time to issue 1099s. Keep W-9s on file as long as your relationship with a contractor is active and for at least four years after filing their last 1099.

What information do you need to issue a 1099?

The three major pieces of information on Form W-9 listed above are the first things you need to know to issue Form 1099. Then, you’ll have to find the following information in your nonprofit’s bookkeeping system:

- The category of the payments made to the contractor

- Federal and state tax withholding information

- The total non-employee (or miscellaneous) compensation the contractor received

Form 1099 is fairly short, but there are penalties for including incorrect information or leaving anything out, so double-check that you have everything you need before you start.

What is the Timeline for Issuing Nonprofit 1099s?

Because each contractor will need to use their 1099 to file their own taxes, your nonprofit will have to complete these forms fairly early in the tax preparation process. The deadline for payers to file all of their 1099s for the previous calendar year is January 31. Of course, the earlier you can get them done, the better.

When you purchase 1099s for your nonprofit, you’ll also find a copy of IRS Form 1096 and related instructions in the pack. This form essentially summarizes all of the 1099s your organization issues and should also be filed by January 31.

What happens if you don’t file your 1099s on time?

There are IRS penalties if your organization fails to file its 1099s by the January 31 deadline, which apply per required Form 1099. Here is a breakdown of the late fines for forms due in 2025:

- $60 penalty for filing up to 30 days late

- $120 penalty for filing more than 30 days late and before August 1

- $330 penalty for filing a 1099 on or after August 1

- $660 penalty for intentional failure to file

If you file multiple late 1099s or make errors on the forms, the fees can really add up, so make sure to complete them correctly and on time!

Master 1099s with our FREE nonprofit course!

Learn MoreBy becoming familiar with what Form 1099 entails and why to issue one, you’ll be able to maintain compliance when it comes to your organization’s contracted workers, and you might just find tax season a bit less overwhelming. However, it always helps to have experts on your side—like Jitasa’s experienced nonprofit accounting team!

For more information on filing tax forms for your nonprofit, check out these resources:

- Form W-9 for Nonprofits: What It Is + How to Fill It Out. Dive deeper into the requirements and best practices for requesting taxpayer information from contracted workers using Form W-9.

- Nonprofit Form 990 Filing: An Essential Tax Guide. Learn everything you need to know about filing your nonprofit’s most important annual tax form—the IRS Form 990.

- Outsourced Accounting for Nonprofits: Top 10+ Firms. Discover the benefits of working with an outsourced nonprofit accountant during tax season and beyond, and explore our top recommendations.