5 Nonprofit Revenue Diversification Tips to Amplify Funding

Wednesday, August 20, 2025 by Delanie Miller

Your nonprofit organization is primarily committed to furthering its mission, but financial management activities are essential to achieving that. One way to ensure your finances are secure and reliable is by generating revenue from multiple sources. This boosts your profits and can help your organization recover more quickly if one source falls through.

Diversifying your nonprofit’s income sources can mitigate financial risk, drive long-term success, and help you provide uninterrupted service no matter the influence of external factors on one source of funding. In this guide, we’ll explore why revenue diversification is so important, the top revenue streams to consider, and how to get started.

Why diversify revenue streams?

The problem with limited revenue streams

A lack of diversity in your nonprofit’s income places you at a higher risk for financial hardship. If something happens to your sole source of money, what will you do to make up for that loss?

For example, say funding from a grant makes up 80% of your revenue for your primary community program. If the grantmaking institution suddenly loses its own funding or decides to redirect the grant you rely on, your organization is left scrambling to find other resources, or else you might have to pause that program.

The benefits of nonprofit revenue diversification

When your funding comes from many places, one source can slow down or end with little disruption to your operations. You may need to replace it, but you will have funding available to cover operations in the meantime.

Diversified revenue streams can also benefit your nonprofit by:

- Mitigating financial risk. A diverse funding model shields your nonprofit from unexpected losses that could significantly impact your ability to deliver the services your community counts on.

- Enhancing organizational flexibility. Relying on a single revenue source, such as a large grant or a gift from a major donor, can limit how your organization uses funding. Multiple sources give you the freedom to pursue innovative projects without needing to constantly appease one funder.

- Helping in times of economic downturn. In the midst of national tragedies or recessions, individual donations may decline as people lower their spending. Having other streams of revenue, like sponsorships, grants, or earned income, can provide a funding safety net.

- Strengthening brand awareness. When your nonprofit can navigate financial challenges and is clearly engaged with multiple funding channels, you’ll be seen as prudent and credible. You’ll secure more support from various sources when people interact with your organization in different ways (e.g., they may not be inclined to donate but are excited about attending one of your events).

Revenue diversification ultimately drives resilience and long-term financial sustainability for your nonprofit. You’ll have the freedom and flexibility to expand your services or implement new initiatives that you know will benefit your beneficiaries most.

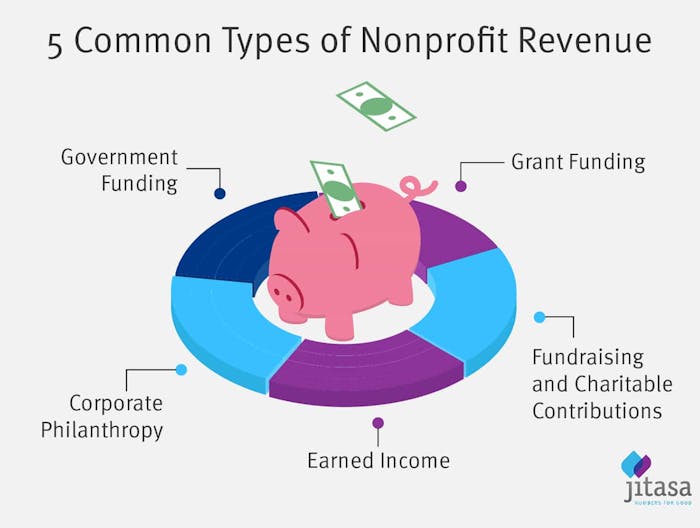

5 types of nonprofit revenue

When it comes to raising money to support their work, nonprofits aren’t limited to charitable donations from their supporters. Here are five common nonprofit revenue sources you can pursue to diversify your income:

1. Grant funding

Many organizations receive a large portion of their revenue from grant funding. Grants are a form of financial assistance from grantmaking institutions like foundations, which see the funding they provide as an investment in a nonprofit whose work aligns with their values.

The size, scope, and application process vary across grants. For example, application processes range from a single form to lengthy documentation of your impact. Most proposals require good storytelling, competent writing, and a compelling description of your organizational characteristics and why they match what the funder is looking for.

Most grants come with requirements for how recipients may spend the money and reporting requirements. Some grantmakers provide all the funding up front, while others pay out grants in installments as long as your nonprofit continues to meet certain conditions (e.g., enrollment threshold for programs), so make sure you know which type you’re applying for.

2. Fundraising and charitable contributions

These contributions include both monetary gifts and in-kind donations of goods and services.

You can bring in individual donations through fundraising events, donor drives, recurring giving programs, capital campaigns, and many other initiatives. Fundraising looks different for each nonprofit and can vary from year to year as organizational needs change.

3. Earned income

Nonprofits can sell products and services to raise funding to support their missions, and have great success! Examples of this range from nonprofit hospitals that fund their activities by charging for medical care to the annual Girl Scout cookie fundraiser. Other nonprofits might charge a fee for membership or sell merchandise to earn income.

There are tax implications to consider with these activities. Unrelated business income (UBI) is income generated by the regular or ongoing sale of products and services that are not substantially related to your organization’s mission. These activities are subject to unrelated business income taxes (UBIT), and your organization will need to file a separate tax form in addition to its annual return.

However, there are certain scenarios in which this income would remain tax-exempt, including:

- The products or services directly promote and educate the customer about the organization’s mission.

- Example: T-shirts or other apparel featuring the nonprofit’s logo and an educational tagline about the cause.

- The items being sold result from exempt activities.

- Example: IRS Publication 598 highlights an example in which a nonprofit maintains an experimental dairy herd for scientific purposes and then sells the milk and cream produced during normal operational procedures.

- The sale is part of a short-term fundraising initiative.

- Example: Girl Scout cookies are only sold for a few weeks at a time.

- The products or services result from volunteer labor.

- Example: A nonprofit establishes a thrift store to boost revenue. The store is run entirely by volunteers and sells donated items.

- The items or services provided enhance convenience for staff, supporters, or members.

- Example: A museum has an in-house restaurant, allowing visitors and staff to eat while attending the exhibits.

Keep in mind that this is a simplified version of complicated tax regulations. Before launching a product fundraiser or filing your taxes, be sure to consult with a nonprofit accountant.

4. Corporate philanthropy

Many corporations engage in corporate philanthropy by implementing corporate social responsibility (CSR) initiatives at their business. These programs provide a framework for promoting social good in their communities and supporting the causes their employees care about.

Here are a few common CSR programs that can be an important source of revenue for your nonprofit:

- Matching gifts When an employee donates to an eligible nonprofit, they can submit a match request to their employer. The company will then match the employee's donation to the cause, essentially doubling the employee’s contribution.

- Corporate grants: These grants are a form of financial support offered to nonprofits by for-profit businesses. Typically, there is an application process similar to foundation grants.

- Volunteer grants: This type of corporate grant is typically awarded to organizations where employees regularly volunteer. Every company has its own guidelines for awarding grant funding, but usually, employees must volunteer a certain number of hours before receiving funding based on the number of hours volunteered.

Some nonprofits also form long-term corporate partnerships with businesses. Not only does this expand their network and supporter base, but it also allows them to take on larger projects by sharing resources and expertise with another organization (e.g., a co-branded cause marketing campaign).

5. Government funding

Many nonprofits receive government funding, usually in the form of a grant. Historically, government-issued grants make up a large amount of available grant funding, although cuts to federal funding sources in 2025 significantly impacted nonprofits that relied on those income sources, impacting their staffing, program delivery, and overall sustainability.

These recent events underscore the need to diversify your nonprofit’s revenue sources, even when it comes to grant funding. If you can, seek out grants from private foundations or corporations to avoid leaning too much on just one source.

Renewable vs. nonrenewable funding

While all funding is appreciated, not all funding is created equal. Some funding happens just once, while other sources are offered many times. Having a mix of renewable and nonrenewable funding is ideal.

Examples of renewable funding

Renewable funding is often the result of annual fund contributions and is usually not restricted. Renewable income can also come from monthly giving programs, multi-year grants, or endowment funds.

Examples of nonrenewable funding

Nonrenewable funding is more unpredictable as it varies year to year. For example, if you sell t-shirts for a one-time event, you can’t count on having this income the following year. In fact, most fundraising efforts are considered nonrenewable.

While both types of funding should be planned for and accounted for in your nonprofit’s budget, renewable funding offers more stability.

5 strategies to diversify nonprofit revenue streams

Knowing what types of funding exist is only half the battle. Being able to actually diversify your income is the next step you’ll have to take. Here are a few tips for getting started:

1. Expand your donor base

This may sound straightforward, but one of the best things you can do is look for new donors to grow your overall donor base and stabilize your organization’s financial standing. A few ways to do this include:

- Boosting your presence on social media and other digital platforms.

- Holding peer-to-peer fundraising campaigns that help you reach current donors’ personal networks.

- Investing in email and content marketing (or even trying out influencer marketing).

- Optimizing your website to make it more visible and findable via search engines.

- Forming partnerships with peer organizations or corporations to reach their communities and networks.

Additionally, make sure you can tap into audiences who will want to support your work for a long time. Engaging potential donors who are likely to donate many times over many years offers a better return on investment (ROI) than engaging those who only donate once. Decide who your audience is, how you might reach them, and what you’ll need to do to build a lasting relationship with them.

2. Form corporate partnerships

Form alliances with businesses in your community without the expectation of financial support. Focus on cultivating relationships with people who know people to strategically expand your network. These relationships can provide many benefits for your nonprofit, including additional revenue.

When reaching out to businesses about forming partnerships, remember to present the reasons these partnerships would be beneficial to them. For example, if you want a business to sponsor your charity 5K, explain that you plan to promote their company by adding their name and logo to the event t-shirt, marketing materials, and venue signage. Additionally, share statistics about the size of your audience and how donors’ interests may overlap with the business’s offerings.

3. Focus on Grants

There are so many grants available, and you’re likely only applying to a small percentage of them. Because the application process can be so time-consuming, it can be advantageous to hire an experienced grant writer. These professionals are experts at writing compelling grant proposals, but they can also help you research grants and develop a grant strategy. A nonprofit accountant may also assist with grant management, helping you use funds effectively and meet the funder’s requirements.

4. Sell Products or Services

No matter your niche, there is probably a product or service you can offer that promotes and educates donors about your mission. Branded merchandise and tutoring services are great (and relatively easy) examples of ways you might make some money and diversify your income.

However, you need an organized way to present and sell the products, and an online store can do just that. With an online store, your organization can:

- Clearly list and describe all of the products or services you offer.

- Customize the store with your organization’s branding and mission statement, providing seamless, trustworthy shopping experiences.

- Smoothly and securely accept various payment methods.

- Adjust pricing as needed to maximize profits in relation to sales quantities.

- Collect and export the contact information of supporters who purchase products.

Ideally, you should look for a platform that allows you to set up your store for free, offers nonprofit-friendly fees on sales, and manages order fulfillment and shipping for you. Additionally, tools designed for fundraising will allow you to collect additional donations from your generous supporters.

5. Steward Your Support System

Always remember to practice gratitude. Show your appreciation for donors with:

- Prompt, personalized thank-you messages.

- Donor appreciation events.

- Free branded merchandise as a thank-you for their ongoing support.

When you build intentional relationships with the individuals and businesses giving you money, they’ll be more inclined to give or tell their friends about your cause. Approach things from an authentic place and find ways to recognize the people who support your organization.

One or two income streams are great, but ten are even better. In a perfect world, you’ll have income from monthly giving, grants, fundraising events, major gifts, and sponsorships—all at the same time. Plan for as many sources of funding as you can responsibly manage, and increase your goals over time to set your nonprofit up for years of continued success.

Jitasa’s bookkeeping and accounting services are affordable and cater to every nonprofit.

Learn More