Church Accounting: Ultimate Guide + Best Practices to Know

Friday, May 3, 2024

As a church leader, your top priority is furthering your church’s mission and ministry. Everything you do in your role—from engaging the congregation to conducting community outreach—depends on your church having enough resources to fund these initiatives and managing its finances through effective accounting practices.

Accounting is important for any organization, but there are some special considerations for churches like yours because of their purpose and structure. That is where this guide comes in—we’ll cover the basics of church accounting, including:

- What is Church Accounting?

- Benefits of Church Accounting

- Key Church Accounting Documents

- Additional Accounting Best Practices for Churches

Let’s get started with an overview of what church accounting is and what makes it unique.

Work with the church accounting specialists at Jitasa to refine your financial management practices.

Request a QuoteWhat is Church Accounting?

Church accounting refers to the organization, recording, and planning of a church’s finances. The process of church accounting is most similar to nonprofit accounting, since every church is also required to reinvest all of its funds into the organization and its mission. However, there are a few small differences between the two that we’ll cover in more detail later.

The primary difference between church accounting and for-profit accounting is its focus. In general, businesses use accounting to maximize their profits, while churches aren’t legally allowed to turn a profit.

Instead, the core of church accounting is accountability. Since your church relies on its congregation’s generosity to acquire the majority of its funding, your accounting practices should focus on demonstrating that you’re handling your supporters’ contributions responsibly and using your funding to make a difference.

Benefits of Church Accounting

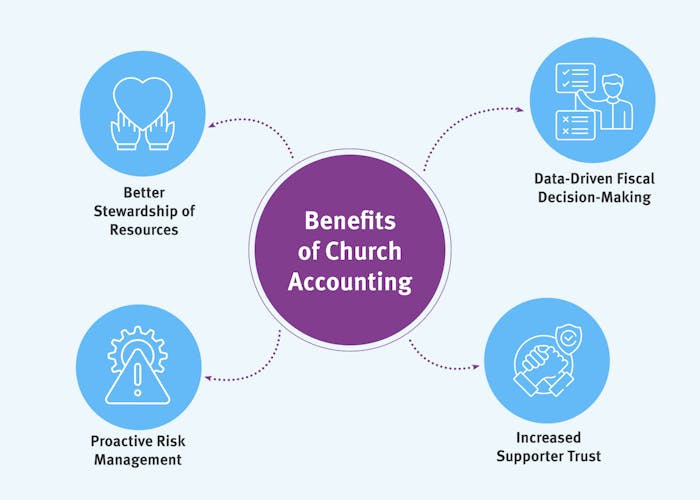

When your church implements responsible accounting practices, you can experience several advantages, such as:

- Better stewardship of resources. By properly tracking and allocating your church’s funding, you can make the most of your resources to serve your community.

- Data-driven fiscal decision-making. If your church keeps detailed records of its finances year after year, you can reference this data to set realistic goals and timelines as you plan for future growth.

- Proactive risk management. Effective accounting practices help protect against financial risks like fraud and theft, which could damage your church’s reputation.

- Increased supporter trust. According to Ministry Brands’ State of Church Giving Report, 57% of the churches that saw increased congregational giving in 2023 achieved those results in part by being transparent about their spending. Financial transparency builds trust with supporters, which can make them more likely to give to your church.

Church accounting is also important for maintaining compliance with legal requirements for religious and nonprofit organizations, as well as the Generally Accepted Accounting Principles (GAAP), which standardize financial reporting and recordkeeping across all organization types.

Key Church Accounting Documents

To get started with church accounting, you’ll need to understand a few notable financial resources and reports. Here is a breakdown of four of the most important document types.

Chart of Accounts

Your church’s chart of accounts is essentially its financial directory. Since most churches receive funding from multiple sources and spend money in various ways, it’s important to keep records organized into categories, or “accounts.” The chart of accounts lists all of these categories in a table-style format, allowing you to easily find the correct records whenever you need to access them.

As with most nonprofit charts of accounts, it’s most effective to split your church’s chart of accounts into the following five categories:

- Assets: Everything your church owns, such as cash, property, and accounts receivable.

- Liabilities: Everything your church owes, including accounts payable, deferred revenue, and debt.

- Net Assets: The total amount your church is worth, which is equal to your assets minus your liabilities.

- Revenue: All of the funding your church brings in through its various income sources (more on this later!).

- Expenses: All of the money your church spends on its ministries, administrative needs like facility upkeep and staff compensation, and revenue-generating initiatives.

These categories are based on the Unified Chart of Accounts (UCOA), a nonprofit-specific, standardized sample chart of accounts. However, many churches find the UCOA too detailed and are better off using other church-specific templates that they can customize to meet their needs.

Track your church’s finances with our customizable Church Chart of Accounts Template

Download for FreeOperating Budget

Your church’s operating budget is its master financial plan for a given fiscal year. You’ve likely created a budget for your household before, in which you predicted your income for the year and allocated it to ensure you could cover all of your expenses. Church operating budgets work very similarly, except that they detail an entire organization’s predicted revenue and expenses.

To make your operating budget as helpful as possible, ensure it features the following characteristics:

- Defined activities. Every aspect of your church budget should be associated with a specific initiative (for example, running your children’s ministry or launching a capital campaign). Record the total amount of predicted revenue and expenses for each initiative in your operating budget, then create separate program or project budgets to provide additional details.

- Specific time frames. Although your operating budget covers one full year, you should also consider how much revenue you’ll bring in each month. Donating to churches and nonprofits alike peaks in December and tends to die down during the summer, so plan ahead to ensure you always have enough to cover necessary expenses. Additionally, if a project spans multiple years, break down your spending and fundraising on a year-by-year basis to align with your operating budget timeline.

- Realistic and measurable goals. This is where past financial records are especially useful—use them to set spending and fundraising goals that will push your team but won’t be out of reach. For instance, if your church raised $10,000 during last year’s year-end giving campaign and $8,000 the year before, setting a goal to raise $12,000 during that campaign this year will likely be challenging but not impossible.

Although you’ll create an operating budget from scratch once a year, budgeting shouldn’t be a one-and-done event for your church. Check in with your budget on a monthly basis to help keep your church on track with its spending and revenue generation throughout the year.

Financial Statements

If your operating budget is your church’s master financial plan, financial statements are your church’s master fiscal reports. Each statement organizes and summarizes your church’s data in a different way to provide insights into its financial situation.

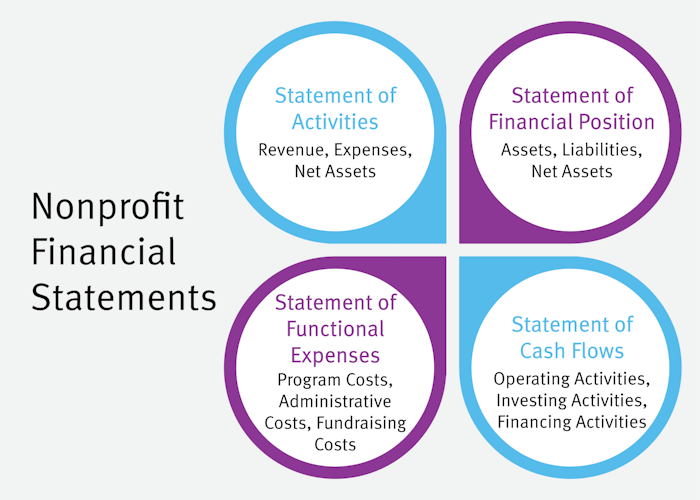

The four main financial statements used by churches and other nonprofits are the:

- Statement of activities. The nonprofit parallel to the for-profit income statement, this document breaks down your church’s revenue, expenses, and net assets to inform future budgeting decisions.

- Statement of financial position. Also known as a balance sheet, this statement provides a snapshot of your church’s financial health and its potential for growth by reporting its assets, liabilities, and net assets.

- Statement of cash flows. This report shows how cash moves in and out of your church through operating, investing, and financing activities. While most organizations compile the other financial statements annually, it’s best to pull this one monthly to track your spending and revenue generation more closely throughout the year.

- Statement of functional expenses. This report breaks down your church’s expenses into the categories of program, administrative, and fundraising costs to provide a more detailed view of how your spending supports your mission.

Financial statements also make excellent external resources. While most churches include a basic financial summary in their annual reports, it can be helpful to attach your financial statements as appendices so that potential supporters who want to learn more about your fiscal activities can do so easily.

Tax Forms

Although nearly all churches are tax-exempt organizations, that doesn’t mean your church can write off tax season! Unlike other nonprofits, most churches don’t have to file an annual tax return via IRS Form 990. However, there are exceptions to this rule, as well as special forms your church may have to complete depending on its income or the state it operates in. Stay up to date on the IRS’s guidelines for church financial reporting to ensure compliance each year.

Additionally, regardless of organization-wide annual filing requirements, your church needs to help its employees file their individual income taxes. Make sure to issue W-2s to each staff member on your church’s payroll and 1099s to any contractors you work with by January 31 of each year to fulfill your tax obligations as an employer.

Additional Accounting Best Practices for Churches

Besides compiling each of the above documents, there are a few other strategies your church should implement to effectively manage its finances. Let’s look at three of these best practices in more detail.

Diversify Your Revenue Streams

In the past, churches brought in the majority of their revenue through in-person donations, such as by passing around a collection plate during services or placing an offering box in the back of the sanctuary. While cash and check contributions are still important for many churches, they’re less significant than they used to be.

According to ChurchTrac’s 2024 church giving statistics, three in five church donors are willing to give via digital means, and just under half actually do. Adding an online donation page to your church’s website that accepts credit card payments, bank account transfers, and mobile payment services like Venmo and Apple Pay makes giving more convenient and accessible for congregants. In fact, Nonprofits Source reports that churches that allow supporters to give online have seen a 32% increase in overall contributions on average!

In addition to accepting digital donations, your church can branch out even more in its revenue generation efforts by taking advantage of opportunities such as:

- Hosting fundraising events like walkathons, auctions, or family fun nights

- Participating in passive fundraising programs like gift card sales or restaurant profit shares

- Applying for grants that align with your church’s mission and needs

- Directly collecting supplies for ministry programming or community outreach initiatives via in-kind donation drives

- Accepting non-cash contributions like gifts of stock, donor-advised funds, and cryptocurrency donations

Having a variety of revenue streams makes your church more financially stable. If one source falls through or some of your expenses are higher than expected, it’s easier to recover when you don’t have all of your funding eggs in one basket. And, if everything goes to plan, you can use your additional revenue to create an emergency fund or save for long-term church growth.

Leverage Accounting Software

Many organizations start out tracking their transactions in a spreadsheet for simplicity. However, as your church grows and its financial situation becomes more complex, you’ll eventually need to switch to dedicated accounting software.

Make sure your accounting solution can handle the unique aspects of church accounting discussed above, such as categorizing multiple revenue streams and creating the financial statements used by nonprofits. If your church wants to pursue grant funding, look for a platform that includes grant management tools to make the process easier.

There are many accounting solutions available for your church to try, so weigh your options and choose the one that best aligns with your needs and budget. (We at Jitasa recommend QuickBooks Online, as it’s the most comprehensive, flexible, and well-known accounting solution that can be customized for churches!)

Work With a Dedicated Church Accountant

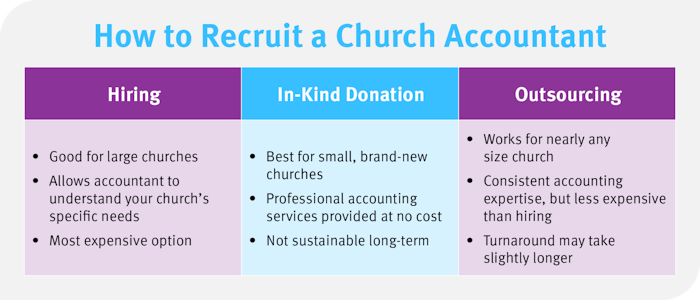

Church accounting involves a lot of moving parts, and working with an accountant can take the burden of financial management off your team and allow you to focus on your mission. You have three basic options for recruiting an accountant for your church, which are:

- Hiring an accountant in-house. This option is best for large churches that have the resources available to hire a new full-time employee and enough accounting work to warrant it. It’s the most expensive option, but this professional will be completely dedicated to your church, so they’ll become very familiar with its needs and goals.

- Requesting an in-kind donation of accounting services. For small churches that are just getting started with accounting, it often makes sense to ask a local accountant to contribute their expertise for free. While this is very cost-effective, it often isn’t sustainable. Although an accountant might be happy to donate their time to a good cause at first, they’ll eventually start to prioritize paid projects.

- Outsourcing your church accounting needs. Outsourcing provides your church with consistent access to specialized accounting expertise at a much lower cost than hiring. Project turnaround might take slightly longer than it would with a full-time accountant, but you can overcome this challenge by communicating effectively with your outsourcing partner.

Especially if you choose to outsource your accounting needs, make sure your accountant has experience managing church or nonprofit finances so they’ll understand your unique financial situation. Our team at Jitasa works exclusively with nonprofits, including churches, so we’re equipped to do just that!

Church accounting allows your team to gain insider knowledge about your church’s financial health and position. That way, you can make plans within the scope of financial possibility at your organization while maintaining as high of an impact as possible. Use the tips above to get started, and don’t hesitate to reach out for professional help whenever you need it!

For more information about church accounting, check out these resources:

- Fund Accounting 101: The Basics and Best Practices. Dive deeper into the unique system of financial recordkeeping and analysis that churches and other nonprofits leverage.

- How to Set up QuickBooks for Nonprofits: The Complete Guide. Discover how your church can get started with the most popular accounting software on the market.

- Bookkeeping & Accounting Services for Churches | Jitasa Group. Explore our outsourced financial management offerings designed specifically for churches like yours.

Learn how Jitasa’s team of experts can help you make the most of your church’s accounting practices.

Request a Quote