The American Rescue Plan: The Nonprofit Complete Guide

Tuesday, May 18, 2021

The COVID-19 pandemic shut down the world as we knew it. All of a sudden, all of our interactions with other people, companies, and nonprofits were forced to take a 180-degree turn. Many organizations and small businesses closed their doors, doomed to never open them again. Luckily, your organization wasn’t one of those unlucky organizations. You kept your doors open and continued moving forward, potentially even thriving during the pandemic.

In an attempt to help the country sustain a healthy economic situation during these challenging times, the government passed legislation to assist small businesses, individuals, and nonprofits, helping them stay on their feet and bounce back in the midst of the pandemic. These acts started with the CARES Act, passed March 27, 2020. Then, the second stimulus bill was passed on December 27, 2020.

Now that we’re knee-deep in 2021, the federal government passed a third stimulus bill, The American Rescue Plan, effective as of March 11, 2021. This act extended some existing programs, like the Paycheck Protection Program, and provided another stimulus check for individuals. But you may be wondering how this legislation impacts your nonprofit.

That’s what we’ll cover in this piece — how nonprofits just like yours have been affected by The American Rescue Plan. Here at Jitasa, we’ve helped organizations just like yours take advantage of each stimulus package, and we’ll continue to do so as the situation evolves.

Navigation

- The American Rescue Plan Overview

- The Latest on the Paycheck Protection Program

- Federal Coverage for Unemployment

- Shuttered Venue Operators Grants

- Grants for State and Local Governments

- Potential Incentives Past The American Rescue Plan

Ready to learn more about The American Rescue Plan for nonprofits? Let’s dive deeper.

1. The American Rescue Plan Overview

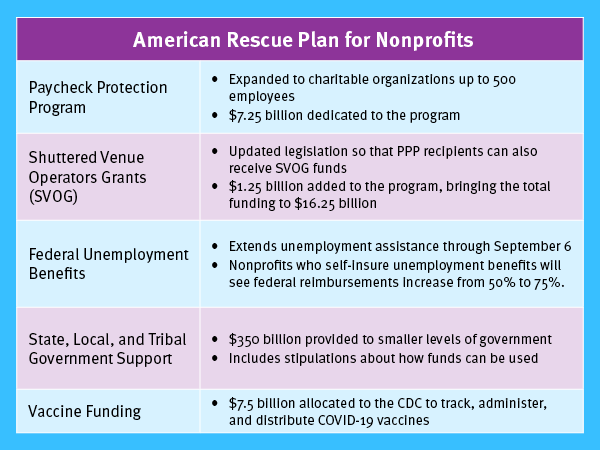

Let’s start with a large-scale view of The American Rescue Plan. Our mini guide below describes some of the attributes from the act that most affect nonprofits like yours:

A lot of this information may look like arbitrary numbers and metrics. However, it’s important to understand how each of these sections of The American Rescue Plan can impact your nonprofit. That’s why, for the rest of the article, we’ll dive deeper into each of these aspects and discuss how your organization could be impacted.

2. The Latest on the Paycheck Protection Program

One of the ways that the federal government is supporting small businesses and organizations is with the Paycheck Protection Program. In the original CARES Act, this was a maximum loan of $10,000,000 to help support the annual salaries for organizations.

Now, with The American Rescue Act, nonprofits with up to 500 staff members are able to extend their use of the program. The government contributed an additional $7.25 billion to the program. Nonprofits who applied can continue supplementing their funds budgeted for salary with forgivable government loans. Jitasa has even been offering to help nonprofits apply for this program since its enactment.

Upon publishing this piece, the application deadline for this extended program has passed. It ended on March 31st, 2021. However, that doesn’t mean you shouldn’t discuss other finance options with a skilled nonprofit accountant. If you’re working on how to make ends meet, reach out to Jitasa to talk to a professional about your organization’s financial situation to make a plan for the rest of 2021.

Related to the Paycheck Protection Program is the Employee Retention Tax Credit (ERTC). Under the first CARES Act, this program was not applicable to organizations who also received the PPP. However, in December of 2020, this program was extended to also include those who had received PPP funds. The ERTC is also now available from January 1, 2021, through June 30, 2021. The benefits of this program during this time may equal as much as $7,000 per calendar quarter.

3. Federal Coverage for Unemployment

If your nonprofit self-insures unemployment benefits, you’re in for some good news! The American Rescue Plan will help with these insurance expenses. The act modified the original benefits put in place by the last stimulus package to include the following two changes:

- The federal payment for a portion of unemployment insurance expenses has been extended through September 6th, 2021.

- The federal coverage for reimbursement of these expenses increased from 50% to 75%.

These changes are enacted for 501(C)(3) classified nonprofit organizations, so organizations outside of this classification should double check their eligibility for this program. Also, don’t forget that this means you’ll still need to pay a portion of the unemployment insurance, so be sure to work that into your budget.

More good news? The federal coverage for reimbursing nonprofits is available for any unemployment claims made during this period, not only those related to COVID-19.

4. Shuttered Venue Operators Grants

The Shuttered Venue Operators Grants (SVOG) consist of funds that are designed to help organizations that have experienced a significant decline in revenue due to the COVID-19 pandemic. It was originally a part of the Economic Aid Act, the second stimulus package signed into effect on December 27,2020.

To be eligible for SVOG funds, your organization must demonstrate a decline of 25% in earned revenue in one calendar quarter of 2020 compared to the same quarter in 2019.

The American Rescue Act amended the original version of SVOG, adding an additional $1.25 billion to the budget and allowing PPP recipients to also apply for these grants. If your organization has also applied for the Paycheck Protection Program, that means you’ll also be eligible to receive funds as a part of the SVOG.

Here are some tips to keep in mind if you decide to apply for SVOG funds:

- You might be required to conduct a nonprofit financial audit. The funds you receive through these grants count as aid provided by government agencies. If you receive more than $750,000, according to the Single Audit Act, you’ll need to conduct a financial audit at your organization. Be sure to keep records of your funds and your use of them for this possibility.

- There may be limitations on how you can use SVOG funds. These grant monies must be used for payroll costs, rent or utilities, payments to independent contractors reported on a 1099-MISC, and other ordinary and necessary expenses. Be sure you accurately track where all of these funds are allocated using grant management best practices. This will help keep all of the expenses straight and prove you used the funds correctly.

The organizations intended to receive these funds are considered shuttered venues, such as theatrical producers, performing arts organizations, museum operators, talent representatives, and theater operators. If you fall into this category, you could receive some additional grant funds from the American Rescue Act, congratulations!

If you have additional questions regarding SVOG funds, you may find the answers provided on the FAQ sheet provided by the U.S. Small Business Administration.

5. Grants for State and Local Government

Throughout the COVID-19 pandemic, one sector that has been struggling immensely is state and local government. At the height of the pandemic, the sector lost 1.4 million jobs and experienced a steady decline in revenue. That’s why The American Rescue Plan included $350 billion to help state, local, and tribal governments to help support public health needs.

According to the Department of Treasury, these $350 billion in funds will be divided as such:

- $195 billion for states with a minimum of $500 million for each.

- $130 billion for local governments with a minimum of $1.25 billion per state and allocated to local governments within that state.

- $20 billion for tribal governments.

- $4.5 billion for U.S. territories.

These funds do have stipulations, but they are intended to help communities recover from the economic downfall during the pandemic. That’s why governments are able to use the monies to support the continuation of a strong public health response, especially as vaccinations are administered.

So how do the grants for state and local governments impact your nonprofit?

Not only will the state and local governments be using these funds to strengthen their crisis response in your community, ultimately helping everyone recover, but they may also provide assistance for nonprofits.

Under the idea of supporting community recovery, state and local governments may use their grant monies to provide assistance to households, small businesses, nonprofits, other impacted industries, and to show support for essential workers.

6. Potential Incentives Past The American Rescue Plan

You may remember that in the CARES Act, there were certain incentives for individuals to continue supporting nonprofit organizations. Individuals who took the standard tax deduction could also take an above-the-line deduction for up to $300 in charitable contributions. This was then extended in the second stimulus package, passed in December 2020.

Unfortunately, The American Rescue Act doesn’t offer this particular incentive for nonprofit contributions. However, another act has been presented that would extend and modify the deduction allowed for charitable contributions during 2021. This piece of legislation is called the Universal Giving Pandemic Response and Recovery Act.

This legislation has not yet been passed into law.

This legislation, if passed, would allow taxpayers who generally take the standard deduction on their returns to take a below-the-line deduction for charitable contributions valued at a third of the standard deduction.

If you’d like to track the progress of this Act, you can do so here.

Even if this is not passed into law, these bipartisan bills are presented in an effort to help nonprofit organizations like yours to stay on your feet despite the negative economic impacts of the pandemic.

Wrapping Up

The American Rescue Plan is designed to help nonprofits, individuals, and businesses all stay afloat during the COVID-19 pandemic. Throughout these challenging times, it’s important that your organization stays on top of all of the relief opportunities and efforts put forward by the federal government. They are only designed to provide assistance!

If you’re not sure how your organization can make the most use of the relief programs or how the different finance opportunities fit into your budget, you can always talk to a professional.

Here at Jitasa, we want to help! Reach out to a trained nonprofit finance expert on our team to discuss The American Rescue Plan and how it can benefit your organization.

If you’re looking for more information about nonprofit finances to help get you through these challenging times, check out the additional resources below:

- Nonprofit Accounting: A Guide to Basics and Best Practices. This guide to nonprofit accounting can help determine the impact The American Rescue Plan can have for your organization.

- Form 990 Filing: Your Essential Guide to Nonprofit Taxes. Keep accurate records of all of your benefits from The American Rescue Plan to keep them for your Form 990. Learn more about this important form with this guide!

If you are seeking assistance with ERTC filings by becoming a Jitasa Client please contact jon.osterburg@jitasagroup.com